This post originally appeared last summer. Now, as we close out 2015, I want to revisit whether the theory actually played out.

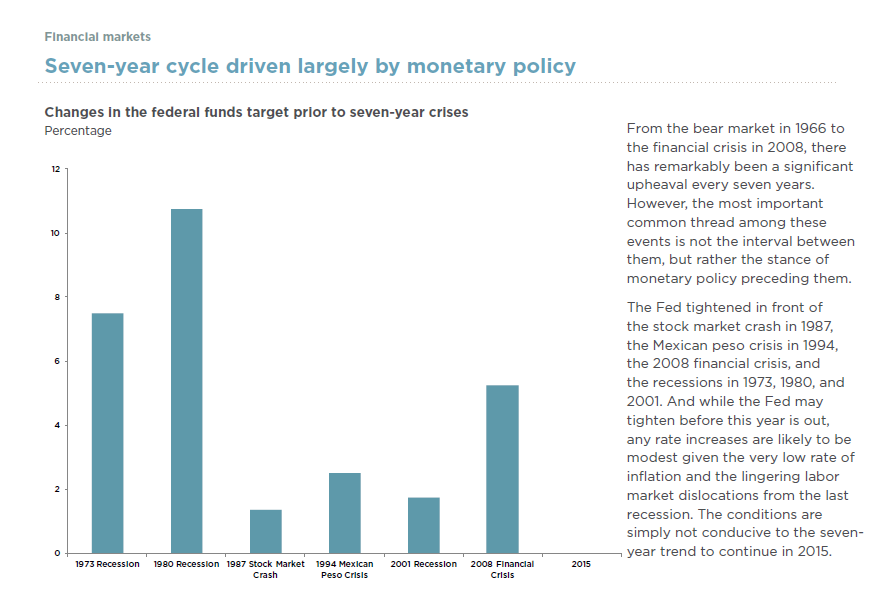

Predictions of doom and gloom in the financial markets or economy tend to try my patience—unless they are supported by fact—so I’m understandably skeptical of the Shemitah, a prophecy that suggests the potential for a financial crisis every seven years. Imagine my surprise, though, when I looked more deeply into this story and discovered that there is something to the theory of a seven-year cycle in U.S. financial markets.