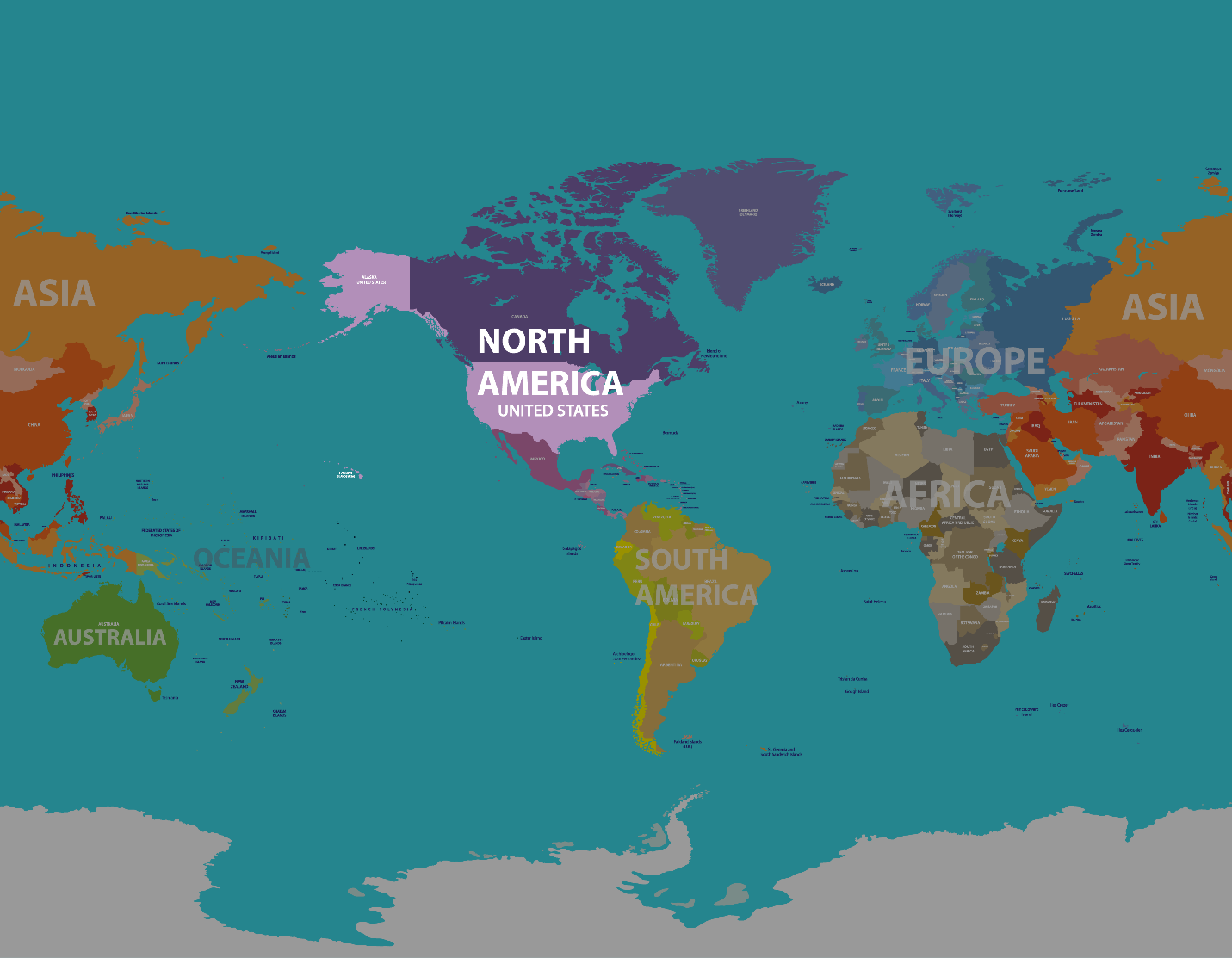

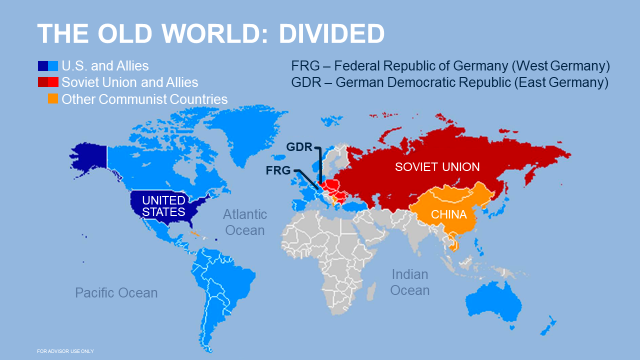

We closed yesterday's post with the idea that the U.S. has been the indispensable market for all rising economies since WWII—starting with Europe under the Marshall Plan and then extending to Japan and subsequently to China and eastern Europe. As the essential market, the U.S. could compel obedience in other areas, notably security, and other countries were happy—or at least willing—to comply.