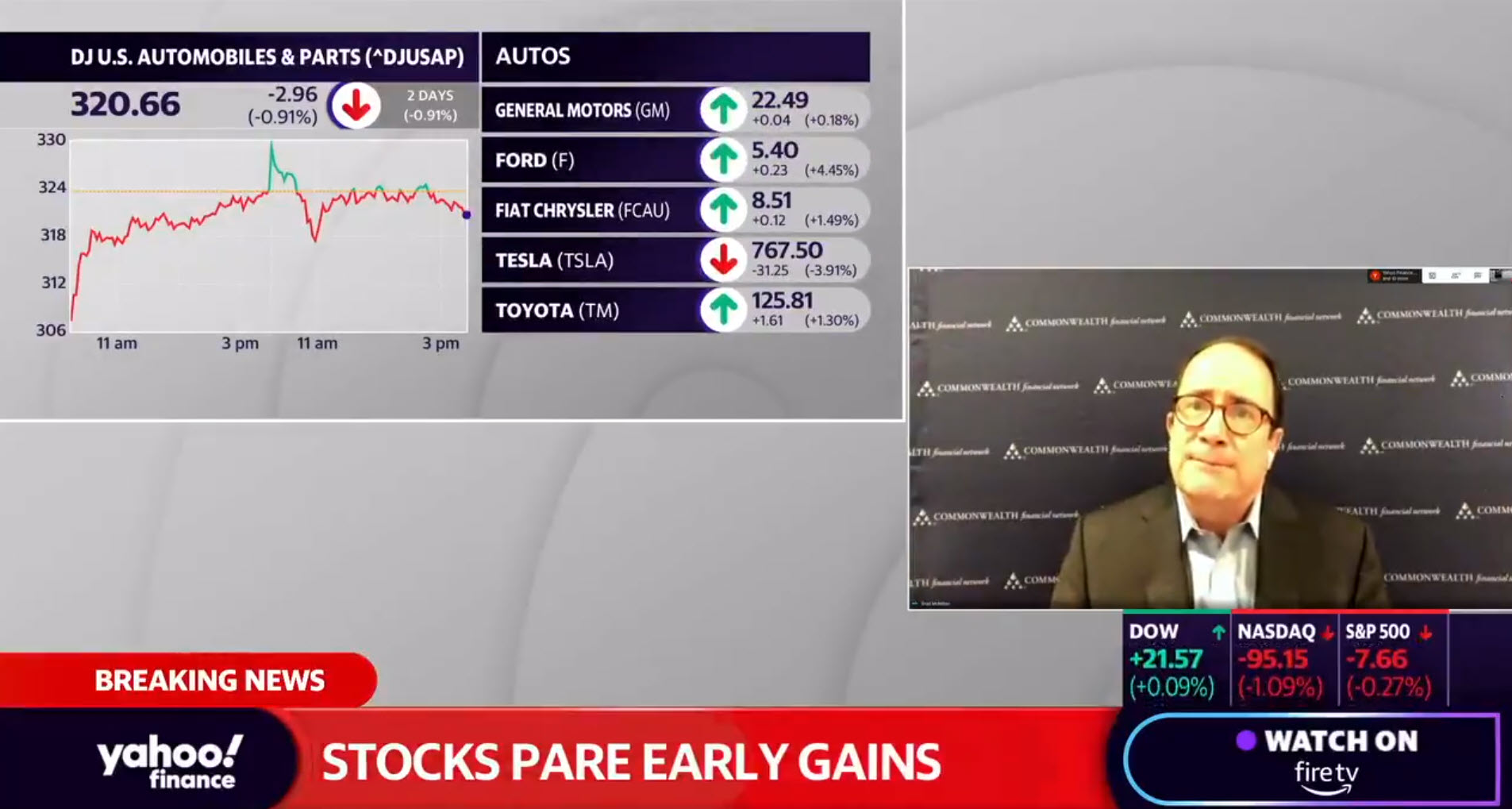

As we did last week, I’d like to provide an update on where we are in the coronavirus crisis. This week, the news has generally been good. The virus continues to come under control, with the growth rate slowing (although the case count has not declined as much). Some states are reopening their economies, which will give us valuable data and should help with employment. Finally, the markets have continued to rally but may have gotten a bit ahead of themselves. Let’s take a closer look.