In this last post on rising interest rates, let's talk about what everyone really wants to know: What do rising rates mean for our investments? As we discussed yesterday, a rate hike probably isn’t imminent, but it’s certainly worth thinking about to get ahead of the risk.

In this last post on rising interest rates, let's talk about what everyone really wants to know: What do rising rates mean for our investments? As we discussed yesterday, a rate hike probably isn’t imminent, but it’s certainly worth thinking about to get ahead of the risk.

Stocks

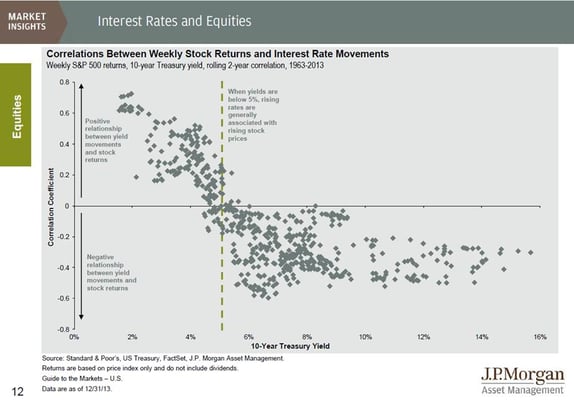

At this point, rising rates actually look like a positive for the stock market, as they reflect a healthier, more normal economy. This chart, which I’ve posted before, shows that stocks typically perform well during periods of rising rates, as long as rates are below about 5 percent—which, by no accident, is the natural level we identified in Part 1.

In theory, stocks should be worth less as rates rise, as the future stream of dividends will be discounted more heavily. Per the Yogi Berra theorem, though, theory and practice are different in practice; the prospect of an improved economy, shown by rising rates, more than offsets this discounting effect. If anything, rising rates may be a positive, at least for the medium term.

Short answer: There are many reasons to worry about the stock market, but rising rates aren’t one of them right now.

Bonds

Bonds are the securities most exposed to interest rate changes. Coupon payments are generally fixed, so they’re hit directly by the higher level of future discounting that comes with higher rates. Simply stated, when rates go up, bond prices go down, with bonds that mature later getting hit harder than those that mature sooner. Long is bad when rates rise, if you sell.

That last sentence highlights the two major ways to manage the rate risk a bond owner faces:

- Longer bonds are more exposed to rate increases, so if that’s a concern, stay shorter.

- As with mutual funds, having to sell, or revalue on a daily basis, is also a way to lock in losses.

The second point deserves a bit more explanation. Consider a 10-year bond, and assume that rates rise and the value of the bond drops from 100 to 98. Mutual funds have to value that bond on a daily basis, and investors in the funds will therefore see the value of their holdings drop by the same 2 percent. Investors who hold the bond directly, however, may not care, as they will continue to collect coupon payments and get a par payment at maturity. As long as they don’t sell, they will not have a capital loss.

So, although bonds are exposed to interest rate risk, it can be managed. Bonds also present some opportunities, as any payments can be reinvested for a higher return as rates rise. For those worried about a capital loss, though, managing the duration of your bonds, or owning them directly, can mitigate that risk. (We actually have a team here at Commonwealth to help investors who wish to directly own bonds.)

Short answer: Rate increases will hit bonds, but the risk can be managed in a couple of ways. If capital loss can be avoided, higher rates will allow higher returns on reinvested funds.

Other Assets

This category includes real estate investment trusts (REITs), master limited partnerships (MLPs), preferred stock, and other financial assets that people buy primarily for the dividend. These will perform somewhere between stocks and bonds, with the growth exposure—possibly good for REITs and MLPs, not usually so good for preferred stock—offsetting the interest rate risk to a greater or lesser extent. It’s not usually possible to manage duration with these assets, however, so investors have one less tool to defend against rate risk.

Short answer: These assets may well see a short-term loss due to rising rates, but for many, growth will offset that loss over the longer term.

Summary

Rising rates, at least at this stage of the cycle, can be risky for parts of your portfolio, but they also have upside effects. A rate increase is something to be cautiously welcomed, as it represents a real recovery for the economy and a more stable foundation for future growth. It will require planning and perhaps some changes to your current holdings, but the risk is definitely manageable while we await the new opportunities.

Print

Print