Once again, it’s time for our monthly update on risk factors that have proven to be good indicators of economic trouble ahead. For the first time since I started this update, we now have a yellow light—in consumer confidence—along with some other signs of weakness.

This is not a signal of trouble in the near future, as the majority of trends remain positive, and we still have a green light overall. Still, although the economy continues to be in growth mode, we are seeing an increase in risk and will need to keep an eye on things.

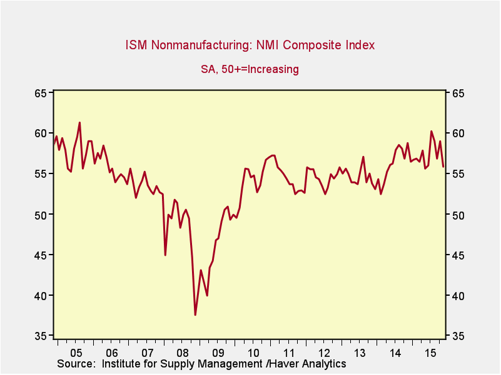

The Service Sector

Signal: Green light

Although the service sector has pulled back from the record levels of recent months, it continues to suggest both business and employment expansion. As a representative sample of the largest sector of the economy, this is an important leading indicator.

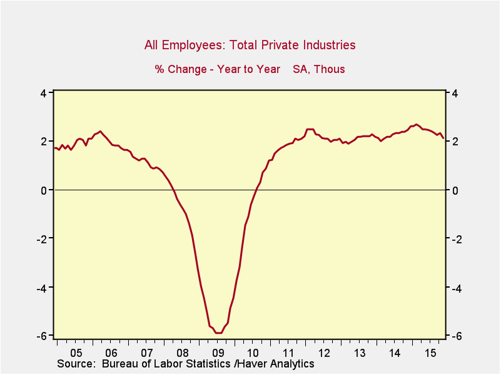

Private Employment: Annual Change

Signal: Green light

Private employment growth year-on-year continued to decrease, largely because of weak third-quarter results, but it remains at healthy levels—at or above those of the mid-2000s. Because this is an annual figure, any change is slower and smaller than what we see in more frequently reported data, but the trend continues to show sustainable and steady growth.

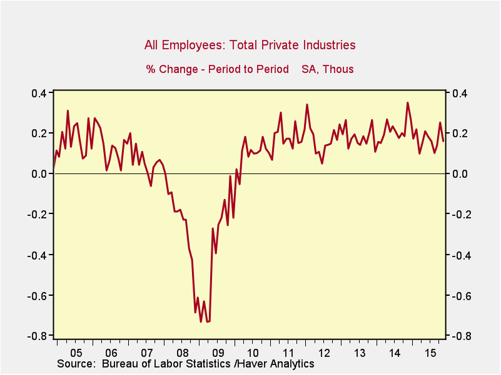

Private Employment: Monthly Change

Signal: Green light

These are the same numbers as in the previous chart, but on a month-to-month basis, which can provide a better short-term signal. Despite a slight decrease after an exceptionally strong October, the November report was positive, and employment remains at a growth level consistent with the mid-2000s. Total employment growth continues to be healthy.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

Rates for the 10-year Treasury ticked up slightly over the past month, while 3-month rates remained relatively stable, widening the spread. The spread between long-term and short-term rates remains healthy, however. This metric has not changed despite the prospect of a Federal Reserve rate increase in December, which seems to be due, at least in part, to demand from international buyers.

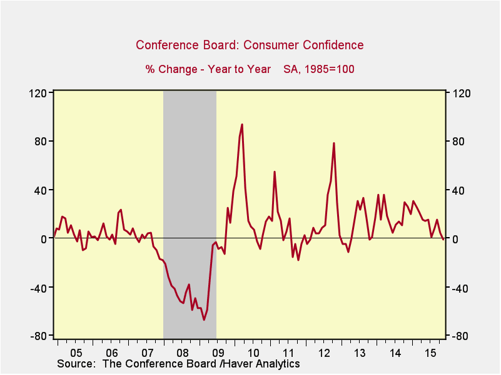

Consumer Confidence: Annual Change

Signal: Yellow light

Consumer confidence decreased substantially this month, bringing the annual change down to flat, after a slowing growth trend over the past several months. The risk level is –20 year-on-year, rather than the current 0, so we are not yet at a worry point, but the risk has increased.

As a result, I am changing this signal to a yellow light, since this is the second month we have seen this kind of downward adjustment (though I do believe there is the real possibility of a rebound next year).

Conclusion: Keep watching, as continued declines could bring us into a danger zone

With the exception of consumer confidence, all of the major signs continue to be positive, although there are signs of weakness. These signs of weakness, combined with the weak consumer confidence indicator, suggest that a slowdown is a possibility, although not a probability at this point. On balance, we still have a green light for the economy as a whole.

Print

Print