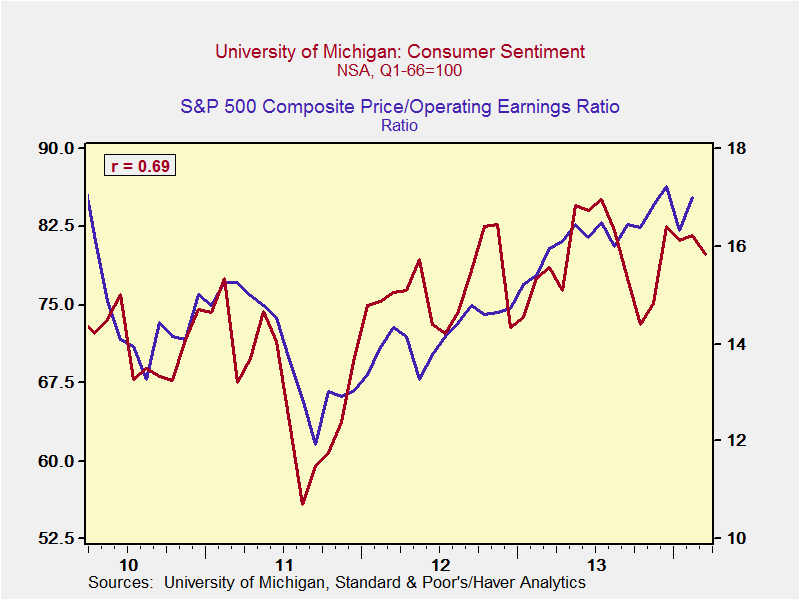

2013 is over. There was a lot of good (have you looked at the stock market?) and a lot of bad (think Washington, DC). There were lots of highs—the stock market again—and lows, such as the EU’s decision to hit Cyprus depositors. Overall, it was a pretty typical year in many respects, although of course we get different highs and lows every year.

2014 will be different. 2013 started with angst and a broken budget; 2014 starts with a smoothly negotiated (if rather minimal) budget deal. 2013 started with worry about fiscal collapse and an exploding deficit; 2014 starts with the deficit projected to decline to below the growth rate of the economy. 2013 started with zero growth; 2014 starts with the most recent quarterly growth figures above 4 percent.