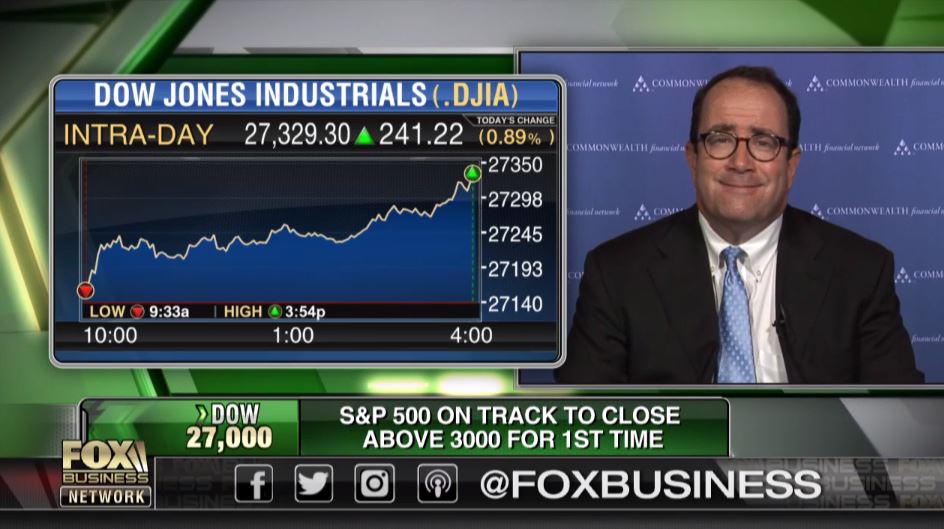

Last week, the economic growth numbers came in stronger than expected, largely due to the strength of consumer spending. At the same time, concerns remain about the slowdown in business investment. Given these conditions, it occurred to me that now is a good time to look at the economy as a whole, to see exactly what it consists of—and what that view might tell us about the future.