Seeing as the world will be ending tonight, that seems to be the only appropriate headline. I’ve stocked up on champagne this week; if I have to go, I want to go with a nice demi-sec—Veuve Clicquot, to be exact—and my family around me. There’s another couple of bottles in the refrigerator, just in case we have to wait a bit.

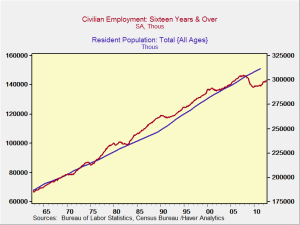

On the other hand, if I don’t have to go, I had better get going on the commentary. In this case, I think the markets are, in fact, a good predictor of the future, as they don’t seem to indicate a significant chance of the world ending. Although they were down a bit yesterday, I would expect a bit more of a sell-off, really, if the world were ending.