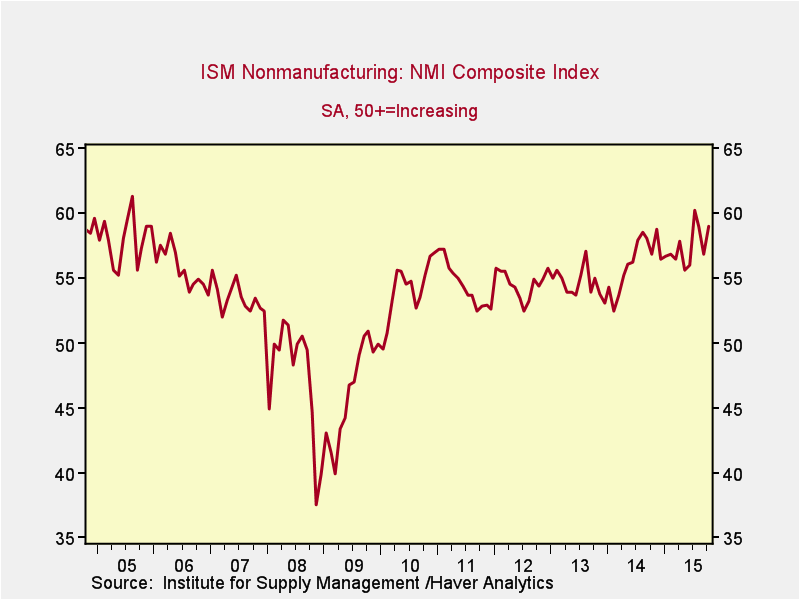

The news this month is much better than last, with the most recent economic data showing sharp increases against previously worrying downward trends. Although one month’s data won’t undo those trends, the consistency of the reversal across multiple data sets and the magnitude of the positive surprises are very encouraging.