Once again, it’s time for our monthly update on risk factors that have proven to be good indicators of economic trouble ahead. On the whole, some of the worrying downward movement has reversed, suggesting that risks may be starting to retreat. The change in consumer confidence metric remains below zero, but even that may be stabilizing. We’re also seeing some signs of stabilization in other areas, such as the yield curve indicator.

Although risks remain, many of these metrics continue to improve on a forward-looking basis, and the overall view remains positive—more so than it has for the past couple of months.

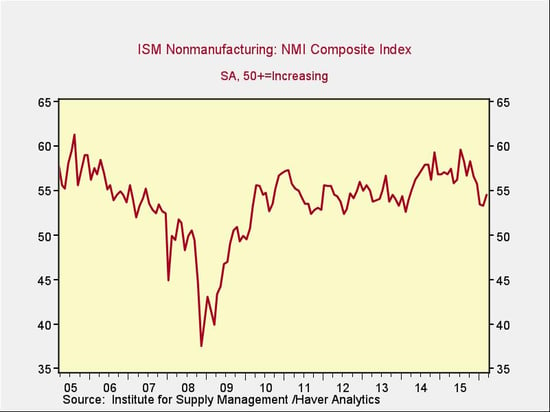

The Service Sector

Signal: Green light

This metric bounced back more than expected last month, supporting the idea that the service sector is regaining its footing after being pulled down by weakness in manufacturing. Although the indicator is below levels of the past year or so, it remains healthy, and we can expect more business and employment expansion. Continued strength in the service sector is consistent with business confidence; as a representative sample of the largest sector of business, this is an important leading indicator.

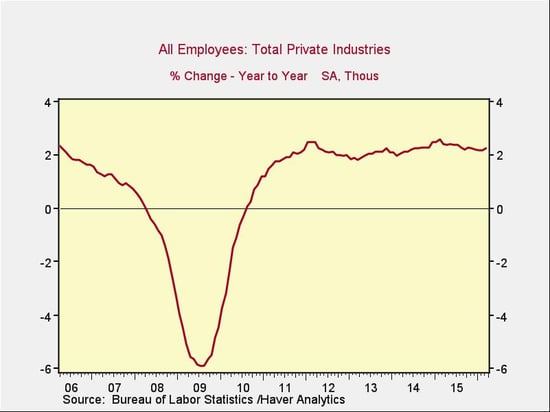

Private Employment: Annual Change

Signal: Green light

Private employment growth year-on-year increased slightly, with reasonably strong numbers in the February and March reports, and remains at healthy levels (at or above those of the mid-2000s), suggesting that the decline in the growth rate may be stabilizing and potentially reversing. Because this is an annual figure, the changes are slower and smaller than those we see in more frequently reported data, but the trend continues to be positive.

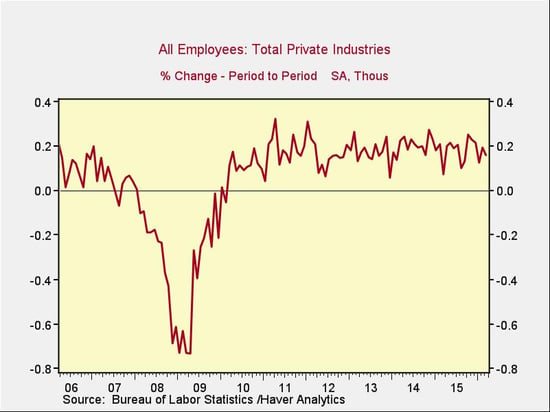

Private Employment: Monthly Change

Signal: Green light

These are the same numbers as in the previous chart, but on a month-to-month basis, which can provide a better short-term signal. Though below the February number, March’s job creation was robust, indicating that employment growth continues at a steady pace and alleviating some of the concern for this indicator. Total employment growth remains healthy, within the range for this recovery.

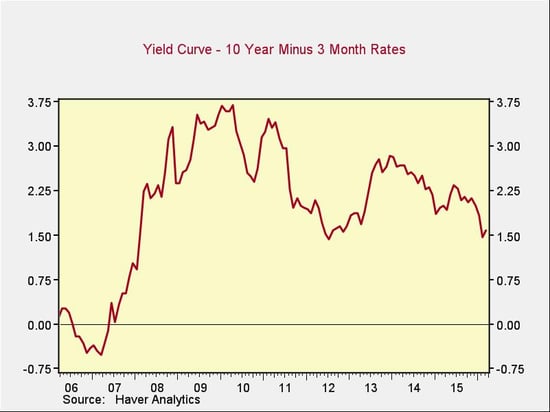

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

Rates for the 10-year Treasury remained relatively stable over the past month, while 3-month rates dropped, and the spread between long-term and short-term rates widened accordingly. Although the spread remains at healthy levels, as with other metrics, the trend over the past couple of months has changed from positive to negative, and it has now extended long enough to suggest this may be a fundamental negative shift. This month’s recovery is a positive sign, but we'll need to keep an eye on this indicator.

Consumer Confidence: Annual Change

Signal: Yellow light

Consumer confidence increased this month, but due to base effects, the year-on-year growth rate declined slightly below last month’s disappointing figure. Although we track consumer confidence on a year-to-year basis, the moderation of the decline, as well as the actual increase on the month, suggests this trend may be stabilizing. The year-on-year growth rate remains well above problematic levels, and the risk is somewhat less than last month suggested. Nonetheless, the current below-zero level (despite recent positive news) suggests this metric isn't out of the woods, and it will remain a yellow light until we see an actual recovery.

Conclusion: Signs of stabilization

With the exception of consumer confidence, all of the major indicators have shown improvement, suggesting that recent downward trends may be moderating and possibly even reversing. If so, the current slowdown may abate.

Although a continued slowdown remains quite possible based on the data, a slowdown is not a recession. And again, the improving data indicates the slowdown may be lifting. One very positive fundamental is the continued strength of employment—the most important of the indicators—as supported by the bounce back in the ISM Non-Manufacturing Index.

Overall, though risks certainly remain, they appear less threatening and less immediate than they did last month, and current conditions still warrant a green light for the economy as a whole.

Print

Print