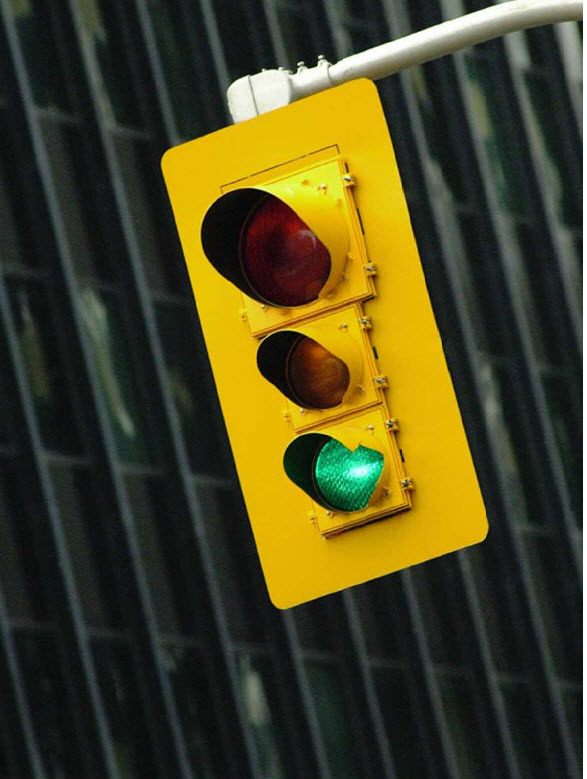

The data for May was mixed. The weak areas—in employment and interest rates—suggest that we might be approaching the end of the recovery cycle. On the other hand, both consumer and business confidence remained high in May, suggesting that the end is likely to be a ways away. Although the data bears monitoring, all of our measures remain in green-light territory, supported by the strength in April’s reports.