Once again, it’s time for our monthly update on risk factors that have proven to be good indicators of economic trouble ahead. For the third month in a row, the consumer confidence indicator is flashing a yellow light. Despite some improvement last month, the data has declined again, which is worrying.

Although one yellow light doesn’t mean trouble in the near future, there are signs that trends may be changing in other areas as well. The risk does not appear to be immediate, but it is rising. That said, many of the signs of a slowdown may be passing on a forward-looking basis, and my overall view of the economy remains positive.

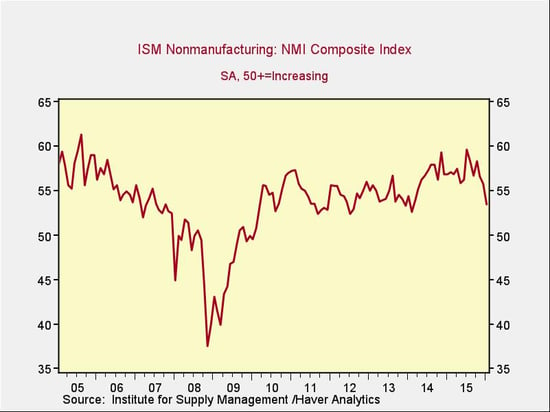

The Service Sector

Signal: Green light

This metric dropped for the third month in a row and is now closing in on the lower levels we’ve seen during this recovery. Despite continuing to expand, the service sector is now clearly being affected by the negative news from the manufacturing sector. We can expect ongoing business and employment expansion, but the trend has started to move in the wrong direction. Strength in the service sector is consistent with business confidence; as a representative sample of the largest sector of business, this is an important leading indicator.

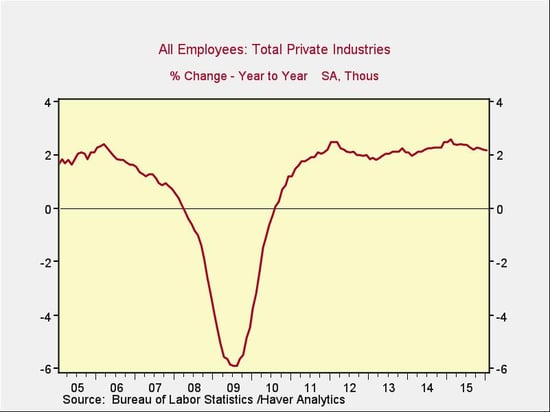

Private Employment: Annual Change

Signal: Green light

Private employment growth year-on-year continued to decrease slightly, largely because of a weak January report, but remains at or above levels of the mid-2000s. Recent strong monthly figures at the end of 2015 suggest the decline may be stabilizing. Because this is an annual figure, the changes are slower and smaller than those we see in more frequently reported data, but the trend looks healthy.

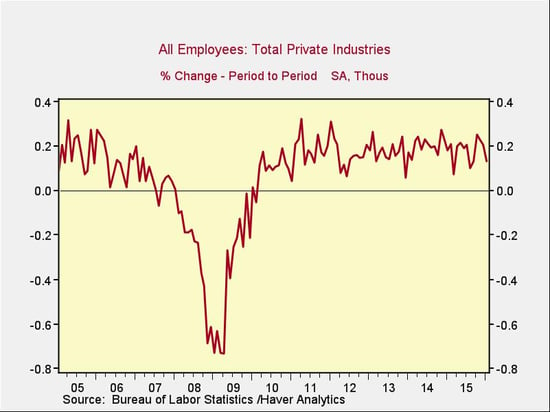

Private Employment: Monthly Change

Signal: Green light

These are the same numbers as in the previous chart, but on a month-to-month basis, which can provide a better short-term signal. January’s job creation was well below that of previous months. Although such volatility is normal (and many of the underlying figures were better than the headline number), this report ties in with other weakening trends. It is quite possibly a bit of giveback from previous strong monthly results and nothing to be too concerned about yet—particularly since longer-term employment growth remains at a level consistent with the mid-2000s. Total employment growth continues to be healthy.

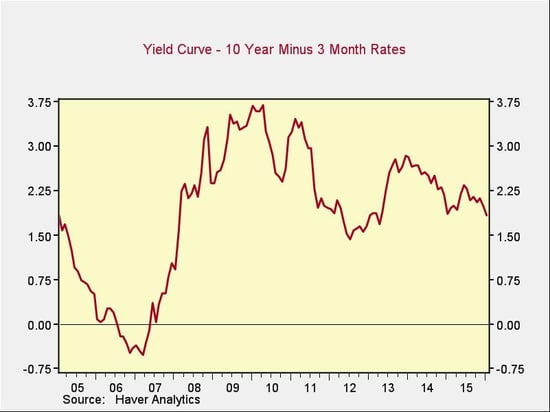

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

Rates for the 10-year Treasury ticked down over the past month while 3-month rates rose, and the spread between long-term and short-term rates dropped accordingly. Although it remains at healthy levels, as with other metrics, the trend has changed from positive to negative over the past couple of months, extending enough to suggest this may be a fundamental negative shift.

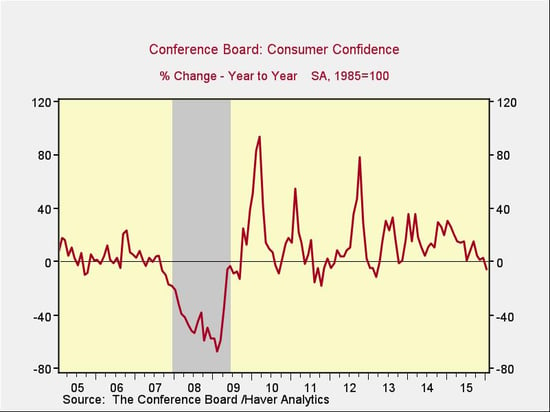

Consumer Confidence: Annual Change

Signal: Yellow light

Consumer confidence growth decreased again this month, taking the year-on-year growth rate below zero for the first time since early 2013. Along with the other changes in trend, this metric suggests that consumers, the main driver of the economy, are starting to worry. Though the year-on-year growth rate remains well above problematic levels, the combination of the recent negative trend and the drop below zero suggests a worry point may not be that far away. This is the third month in a row that this metric has flashed a yellow light.

Conclusion: Economy stable, but further declines could signal a slowdown

With the exception of consumer confidence, all of the major signs continue to be positive. At the same time, all except employment show multi-month changes in trend downward. Employment is the most important of the indicators, but the consistent trend reversals in other metrics may suggest we have moved into a significant slowdown.

A slowdown is not a recession, which is why I’m leaving the overall indicator at a green light. With continued weakness, more yellow lights next month are a real possibility. On balance, however, the economy as a whole remains in stable territory, despite growing concerns.

Print

Print