Brad here. My colleague Nate Parker, senior investment research analyst on Commonwealth’s Investment Management and Research team, takes over today to discuss investment in gold and historical trends in gold prices in volatile markets. Take it away, Nate!

Brad here. My colleague Nate Parker, senior investment research analyst on Commonwealth’s Investment Management and Research team, takes over today to discuss investment in gold and historical trends in gold prices in volatile markets. Take it away, Nate!

Due to gold’s rarity and durability, which makes it valuable and suitable for long-term storage, investment in gold has a long history. According to the National Mining Association, gold was first employed many millennia ago in Eastern Europe to decorate objects; subsequently, its use became widespread in jewelry. Gold has also been used as a medium of exchange for international trade, and the U.S. used the gold standard to value currencies until 1971. Today, our question is, given recent stock market volatility, should investors consider adding gold to their portfolios?

Supply and demand

As with financial assets, such as stocks and bonds, the price of gold is influenced by supply and demand. Mine production and recycling are the two sources of gold supply. The jewelry industry represents the largest source of demand for gold, with China and India being the two largest consumers of gold jewelry. Investment in gold, through options such as bullion, coins, and ETFs that store gold bullion, is the second-largest source of demand. Central banks that own gold as a reserve asset are also a significant source of demand.

Industrial uses for gold, such as electronics manufacturing, represent less than 10 percent of demand for this metal. Silver and other commodities are in higher demand for industrial purposes. Because investment represents a large portion of gold demand, gold prices tend to hold up during a slowing economy or stock market decline.

Gold prices

Gold prices are sensitive to macroeconomic factors and monetary policy, including currency exchange rates, central bank policies, interest rates, and inflation. The Fed’s interest rate policy and the exchange rate of the U.S. dollar, for example, influence gold prices. These complex factors make it difficult to forecast gold prices.

Interest rates

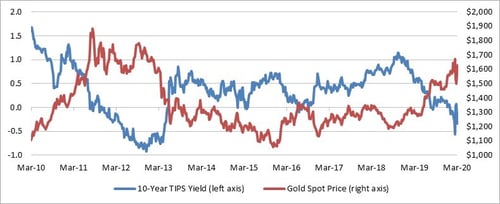

Recently, there has been a strong relationship between real interest rates and gold prices. A real interest rate adjusts for inflation by measuring the difference between the nominal interest rate and inflation. (The nominal interest rate refers to the stated interest rate on a loan, without reference to fees or interest.) The chart below illustrates the historical relationship between gold prices and real interest rates using the real yield (yield above inflation) of 10-year U.S. Treasury inflation-protected securities (TIPS) as the benchmark. TIPS bonds are indexed to inflation, have U.S. government backing, and pay investors a fixed interest rate. Their principal value adjusts up and down based on the inflation rate. As you can see, real interest rates and gold prices have often exhibited an inverse relationship.

Real Interest Rates (%) Vs. Gold Price ($/oz.)

Source: Bloomberg

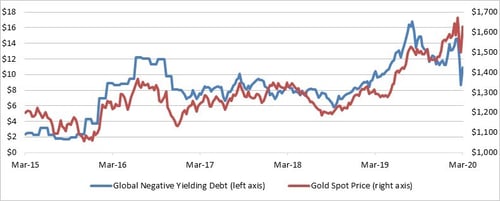

This relationship is also visible in the chart below, which shows the close link between gold prices and the value of bonds that have a negative yield. Both charts illustrate the increasing appeal to investors of gold when real interest rates are low or negative. Conversely, time periods with higher real interest rates tend to be less favorable for gold, as gold produces no income for investors. The current market environment of low real interest rates is certainly a positive that may signal increased interest in gold on the part of investors.

Global Negative-Yielding Debt ($ trillion) and Gold Price ($/oz.)

Source: Bloomberg

Gold as an investment

As with low or negative real interest rates, investment in gold can serve as a safe-harbor investment for investors during periods of heightened economic or geopolitical distress. Currently, gold prices are near a seven-year high due to recent market volatility and sharp decline in interest rates. As measured by portfolio performance, gold has a low correlation with other asset classes. During some time periods, it can increase in value, while other investments fall in value.

Risks to watch for

Investors should keep an eye out for market environments that are negative for gold prices. For instance, a positive outlook on economic growth and an increase in real interest rates would present a poor outlook for gold. Furthermore, gold is difficult to value, given that this investment has no cash flow or earnings metrics to measure. Finally, gold prices are volatile. During some historical periods, the price of gold has demonstrated comparable volatility to that of the S&P 500. Therefore, given gold’s volatility and lack of income stream, gold may not be appropriate for more conservative investors in need of income.

Investment outlook

Although the gold markets are subject to speculation and volatility, the prospects for gold prices currently appear favorable, based on economic growth concerns due to the spread of the coronavirus, low real interest rates, and recent market volatility. Although past performance is no guarantee of future results, gold prices peaked around $1,900 per ounce in September 2011. There’s no way to know for sure where the markets will go, but the current economic turmoil suggests the possibility that we’ll see higher gold prices.

Investments are subject to risk, including loss of principal. The precious metals, rare coin, and rare currency markets are speculative, unregulated, and volatile, and prices for these items may rise or fall over time. These investments may not be suitable for all investors, and there is no guarantee that any investment will be able to sell for a profit in the future.

Print

Print