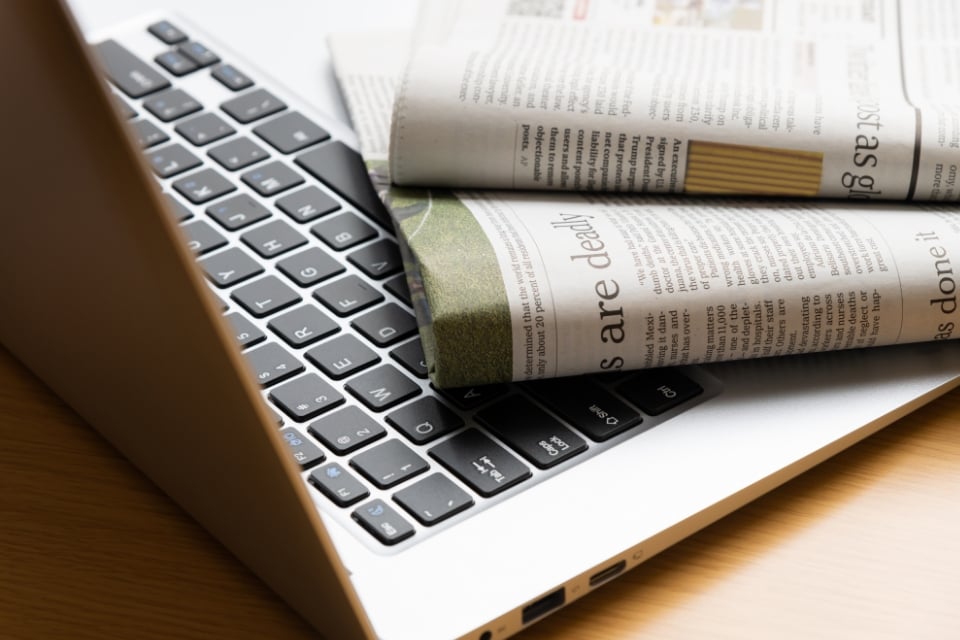

Bonds had a solid start to 2025, with most high-quality fixed income sectors up low- to mid-single digits through the first half of the year. While stocks experienced a roller-coaster ride powered by policy uncertainty, fixed income generally held up well despite the broader market turbulence. Will it be the same story in the second half? Let’s take a closer look.