Last week, the economic growth numbers came in stronger than expected, largely due to the strength of consumer spending. At the same time, concerns remain about the slowdown in business investment. Given these conditions, it occurred to me that now is a good time to look at the economy as a whole, to see exactly what it consists of—and what that view might tell us about the future.

Last week, the economic growth numbers came in stronger than expected, largely due to the strength of consumer spending. At the same time, concerns remain about the slowdown in business investment. Given these conditions, it occurred to me that now is a good time to look at the economy as a whole, to see exactly what it consists of—and what that view might tell us about the future.

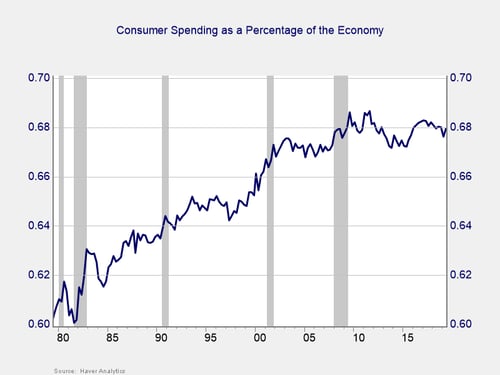

Consumer spending

Let’s start with the headline from last week: consumer spending. As you can see in the chart below, consumer spending is more than two-thirds of the economy, which makes it by far the most important sector. Growth in the consumer sector can keep the economy expanding even if other sectors are flat or contracting. Solid consumer spending is why we had stronger growth than expected last quarter. You can see that consumer spending has become much more important since 1980 but that it has recently stabilized as a percentage of the economy. Finally, note that consumer spending as a percentage of the economy tends to remain fairly stable during recessions.

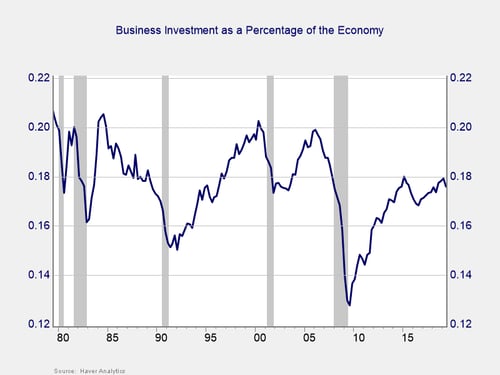

Business investment

Business investment is less than one-fifth of the economy, and it has been generally flat since 1980. This series, however, is variable and tends to drop substantially before and during recessions. As such, it can make a good bellwether for trouble ahead. But since business investment is a significantly smaller part of the economy compared with the consumer, dips here have much less immediate impact—which explains why the economy still expanded last quarter despite the small drop in investment.

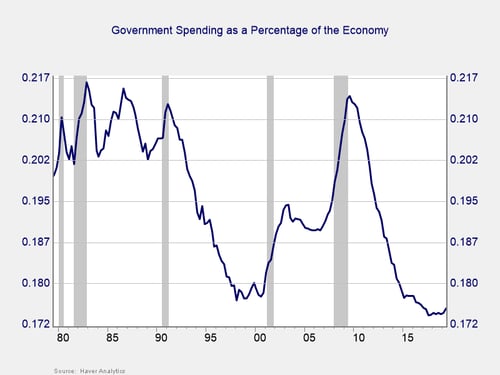

Government spending

The third piece of the economy is government spending. It, too, is about one-fifth of the economy, like business investment, and is highly variable as a percentage of the economy. If you take a close look, however, the two sectors change in opposite ways. Before and leading into recessions, as noted above, business investment declines. Government spending, on the other hand, increases, with the correlation at 79 percent. In real-world terms, these two components are about the same size and change in opposite directions. As such, they pretty much offset each other.

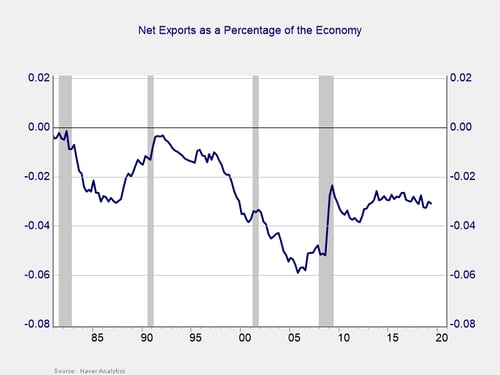

Net exports

The last piece of the economy is net exports (i.e., how much we export less how much we import). In fact, we import more than we export. So, net exports subtract from growth, by between 3 percent and 4 percent per year. This percentage is a real loss, but it is not nearly as big as the headlines would suggest and has been a consistent drag for the past 40 years.

What does it all mean?

To recap, we have four sectors: consumer spending, business investment, government spending, and net exports. One is very small (net exports), and the other two (business investment and government spending) are relatively small and offset each other. The only one that really determines growth is consumer spending. That sector is what drives the economy forward.

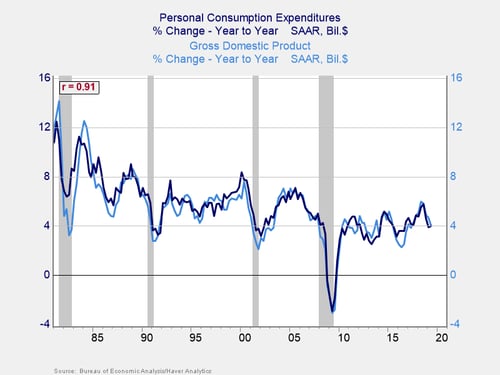

You can see that connection clearly when you graph consumer spending growth against the growth of the economy as a whole. The correlation is more than 90 percent, which suggests one determines the other. In light of this relationship, the stronger-than-expected performance of the economy last month is no surprise after all.

Economic engine is revving

Looking forward, a recent rebound in consumer confidence, continued job growth, and ongoing wage growth suggest consumers should be able and willing to keep spending more. High saving rates, by historical standards, reflect that idea as well. Although there are other things we can and do look at, the consumer is the real engine of the economy. Right now, that engine looks likely to keep revving.

Print

Print