With this morning’s report on economic growth, we see that the economy has beaten expectations once again. Markets anticipated growth would drop from 3.1 percent in the first quarter to 1.8 percent for the second quarter. Instead, the first estimate is for growth of 2.1 percent. That number doesn’t sound like a major difference, but it’s actually a big deal. Let’s take a look at why.

With this morning’s report on economic growth, we see that the economy has beaten expectations once again. Markets anticipated growth would drop from 3.1 percent in the first quarter to 1.8 percent for the second quarter. Instead, the first estimate is for growth of 2.1 percent. That number doesn’t sound like a major difference, but it’s actually a big deal. Let’s take a look at why.

Solid Q2

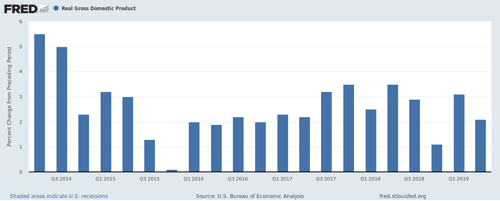

Over the past five years, growth of 2 percent and higher has been the most common result. There have been only a handful of sub-2 percent quarters, so the Q2 result is a good one. Yes, growth is down a bit from the first quarter. But it is consistent with most of 2016 and the start of 2017. Nothing to see here.

In fact, the number is even more impressive than it looks. The first quarter’s faster growth benefited from two large one-time factors: net exports and inventory growth, which were driven by companies stockpiling ahead of expected tariffs. Those factors were anticipated to reverse and subtract from growth in the second quarter. To be sure, they did so substantially, taking off 1.6 percent from growth. Despite that headwind, however, growth still managed to come in at decent levels. This outcome suggests conditions are even more solid than the headline number indicates.

To get a better idea of the overall effect of net exports and inventory growth, if we average the first two quarters to take away the influence of these two factors, growth for the first half of the year comes in at 2.6 percent. Again, that result is at the upper end of what we have seen in recent years.

Consumers made the difference

The reason for the second-quarter outperformance, despite the headwinds, was the consumer. Just as we saw with the surprisingly strong retail sales growth last week, consumer spending growth accelerated sharply. It almost quadrupled from 1.1 percent in the first quarter to 4.3 percent in the second. This jump was driven by continued strong hiring and wage growth, and it was supported by high confidence levels. With consumer spending composing more than 70 percent of the economy, that outperformance made the difference. Government spending growth was also surprisingly strong, which was a further tailwind.

Not all the news was good

Business investment declined slightly, largely on less spending on buildings, which was below expectations and is a worrying sign going forward. Part of this decline might have been driven by the rise in interest rates over the past couple of quarters, however, which hit both residential and commercial construction. If this is the case, the recent drop in rates should help growth recover. Nonetheless, business investment is an area that will need to be watched.

What’s next?

The final question we need to look at from this morning’s growth report is what it tells us about the next couple of quarters. Here, the news is positive. With job growth steady overall, with wage growth at high levels for the past several years, and with confidence high, consumers are likely to keep spending. Also supporting this view is the personal savings rate, which is at a historically high 8.5 percent and, with the recently lower interest rates, could support even faster spending growth. Government, with the recent spending deal that removed pending cuts, is also likely to remain a tailwind.

With these positive factors staying in place, and with the normalization of trade and inventory factors, we have a solid foundation for growth over the next quarter or more. Although business investment remains a concern, unless it really collapses, much of the damage has already been done.

Fundamentals are positive

Overall, this was a very solid report and one that shows the economy continues to confound the doubters. Although risks certainly exist and we need to watch them, the fundamentals remain positive.

Print

Print