As we discussed yesterday, the world is always changing. But in the past couple of years, there has been a growing sense that the changes we’re seeing now go beyond what is normal. From an investment and economic perspective, it seems these changes might be getting systemic enough that, over the next decade or so, it really will be different this time. To understand what might happen next, though, it is important to understand where we are starting from—as the next world will inevitably evolve from the now world.

As we discussed yesterday, the world is always changing. But in the past couple of years, there has been a growing sense that the changes we’re seeing now go beyond what is normal. From an investment and economic perspective, it seems these changes might be getting systemic enough that, over the next decade or so, it really will be different this time. To understand what might happen next, though, it is important to understand where we are starting from—as the next world will inevitably evolve from the now world.

The now world

So, how can we think of the now world? This question is harder than it seems. It reminds me of a story from a David Foster Wallace speech in which two younger fish swim by an older fish. The older fish nods and then asks, “How’s the water?” The younger fish swim on, and then one asks the other, “What the heck is water?” We're facing the same problem in that we have grown so used to what things are like right now that it is hard to imagine they were—or could be—different.

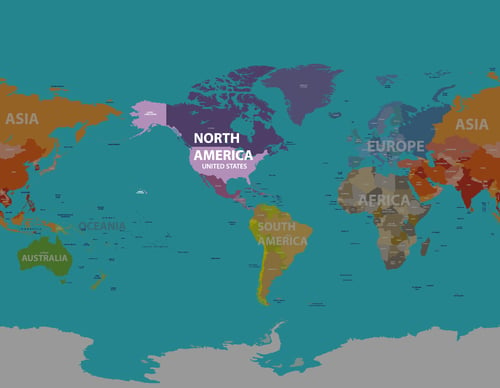

Economic efficiency. From my perspective, the distinguishing factor of the now world is that it is designed around economic efficiency—and around U.S. primacy. Let me give you an example. The map above is a pretty good presentation of how most of us (including myself) view the world. It seems like a very clear and even obvious display.

Maps, however, have embedded assumptions. Two that jump to mind immediately are the centrality of the U.S. (right in the middle of the map!) and the fact that the whole world is presented pretty much the same. We have one world, with all countries treated the same, but with the U.S. in the middle.

From a U.S. perspective, could there be a better representation of an economically optimized world? Companies can source labor, materials, and capital from wherever makes most sense. They can scale their markets and reduce their costs even further by selling into markets around the world.

Consider, for example, product labels. When I was a kid, they were in English—period. Now, products are manufactured and designed to be sold in multiple markets. So, here in the U.S., we see labels in English, French, and Spanish. In Europe and Asia, it’s even more comprehensive, but even there English is on the list—and usually first. Just see the wine labels above.

A world of firsts. This is the now world, one that for almost the first time in history allows something close to free trade around the world. For the first time in history, companies can operate on an economic basis, free of political constraints. For the first time, workers in China can benefit from demand in the U.S., while consumers in the U.S. can benefit from cheaper Chinese labor. For the first time, borrowers can access capital from around the world, while savers can get higher yields from more productive borrowers.

This economic efficiency has been a decades-long trend, and it is one we have all gotten used to and now take for granted. Almost everyone in the world—including the U.S.—has benefited, and hundreds of millions have been lifted out of poverty. Has there been collateral damage? There certainly has, and it should not be minimized. But the overall economic effects have been amazingly constructive. It has been so effective and pervasive, in fact, that we now take this kind of prosperity for granted. This is the water we swim in and can’t even see.

The problem? As much as we take an economically optimized global market for granted, we shouldn’t. It does not have to be this way—and not that long ago, it wasn’t.

The old world

Tomorrow, we will look back at the old world—one centered around politics and not economics—and see just how much it differed from the now world we live in. We will also take a look at the very real benefits, which are definitely quantifiable and material, from this change.

Print

Print