— Guest post from Peter Essele, CFA, senior investment research analyst

Every Thursday, the talking heads on CNBC make a big fuss about the initial claims numbers, pointing out whether they’ve moved up or down from the preceding week. Often, they eat up a good 10–15 minutes of airtime squawking over the fact that the newly released numbers are either above or below historical levels.

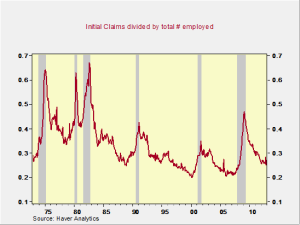

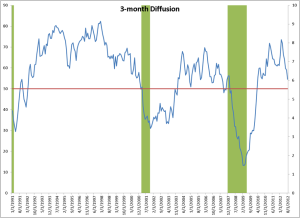

Although this makes for good entertainment, it does little to address the big picture. In order to draw some actual conclusions about how we look against historical norms, we’ve put together the following chart, which shows the number of initial claims for unemployment insurance divided by the total number of employed citizens. When the line moves north, it’s an indication that claims are increasing relative to the number of employed individuals. When it moves lower, it signals an improving employment picture (employment outpacing claims).

Currently, we’re at some of the lowest historical levels in terms of initial claims relative to the number of employed individuals. The prognosticators on CNBC like to compare the initial claims number with historical values in insolation, but, as the chart shows, the number of new claimants represents less than 0.3 percent of the total employment pool. In terms of employment health, this paints a pretty good picture.