Looked at in financial terms, the Federal Reserve (Fed) has done its bit by expanding the monetary base. There is quite a bit of money ready to go, and when it gets put into the economy, we will see inflation. But first, we need consumers and business to borrow and spend that money. That hasn’t happened yet; when it does, then we’ll need to worry about inflation. So it gives us a list of things to watch for:

- The unemployment rate decreases. As excess labor is absorbed, companies will be forced to raise wages, which in turn will increase spending power. This is a necessary condition for inflation to move significantly higher, barring a rise in input costs, such as an oil shock. This will also signal increased growth, which should lead businesses to start investing again.

- Banks start lending/consumers start borrowing again. This will probably lag increased employment, as people won’t/can’t, borrow without jobs, but once employment recovers, borrowing will most likely be close behind.

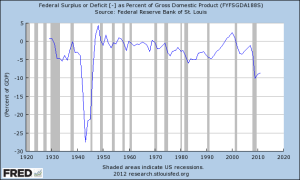

- Growth in gross domestic product (GDP) ticks up. This will be an inevitable consequence of 1 and 2, but it is still worth watching as a leading indicator. Growth absorbs labor, materials, and everything else, and by increasing demand, it will certainly stoke inflation.

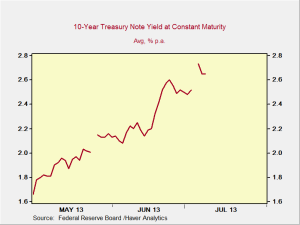

Even when some or all of these occur, inflation will not necessarily be on the immediate horizon, as there is still quite a bit of slack to work through—but it will be getting close. At that point, we should also see bond yields start to increase, which brings us to the investment implications.

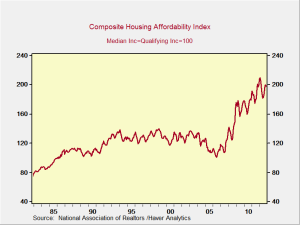

Because we know inflation will increase eventually, any investments intended for more than a year or so should bear that in mind. For fixed income, shorter durations both limit the price risk and provide the opportunity to reinvest sooner at potentially higher rates. For equities, buying stocks that may potentially respond favorably to inflation, such as real estate investment trusts or commodity stocks, might make sense. For people who own or plan to buy homes, it would make sense to lock in today’s low rates.

None of this is to say that inflation is imminent—it is not. At some point, though, growth will resume, and the excess capacity that we presently have will be used up. As I have said, I believe that the U.S. economy has started a sustainable recovery, and if it is not derailed by actions from Washington, DC, that recovery may well result in inflation sooner than anyone now thinks. If so, that will actually be a very positive outcome, as it will mean we are finally through the aftermath of the financial crisis and into a more normal world.

Investments in commodities may have greater volatility than investments in traditional securities, particularly if the instruments involve leverage. The value of commodity-linked derivative instruments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political, and regulatory developments. Use of leveraged commodity-linked derivatives creates an opportunity for increased return but, at the same time, creates the possibility for greater loss.

Real estate investments are subject to a high degree of risk because of general economic or local market conditions; changes in supply or demand; competing properties in an area; changes in interest rates; and changes in tax, real estate, environmental, or zoning laws and regulations. REIT units/shares fluctuate in value and may be redeemed for more or less than the original amount invested.