Seems like the central banks’ soothing is working. U.S. markets were up yesterday, and international markets are up broadly today. Even the narrative has changed, with neither of the major papers dealing with the central banks or the markets on the front pages, and the only real discussion in the Wall Street Journal being “A Hawkish Signal Bernanke Didn’t Send.” Got that? Nothing to see here. Move along.

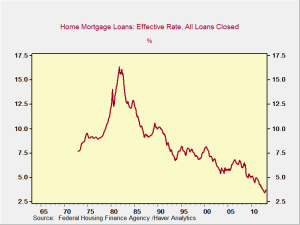

I don’t usually focus on short-term market movements, but one of the things I found interesting yesterday was that, even as rates ratcheted up through most of the day, U.S. stock markets rallied. Although one day is far too short a time to draw conclusions, at least at that scale we have demonstrated that equity markets can do well while rates increase. We also have historical evidence that this is the case, over much longer time periods.