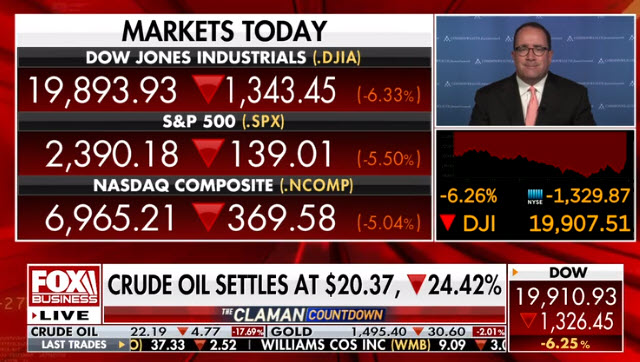

Today, I'd like to provide an update on the coronavirus crisis, including how it has affected the economy and financial markets thus far. While case counts have gone up, the growth rate (a better indicator) has started to trend down in the U.S. Unfortunately, the economic damage has just started to appear, as evidenced by the three million new unemployment claims last week. The government has stepped in with a $2 trillion stimulus package, a move that led the markets to stabilize.