Monday, March 9, will be the 11th anniversary of the bull market that started back in 2009. With recent pullbacks and turbulence around the coronavirus, it is reasonable to worry that this anniversary will be the last and that a bear market will break the streak sometime in the next year. As such, now seems a good time to consider where we stand—and where the market might be headed.

Monday, March 9, will be the 11th anniversary of the bull market that started back in 2009. With recent pullbacks and turbulence around the coronavirus, it is reasonable to worry that this anniversary will be the last and that a bear market will break the streak sometime in the next year. As such, now seems a good time to consider where we stand—and where the market might be headed.

What really drives returns?

Let’s start with the fundamentals. Markets rise and fall on two things: earnings and valuations. If earnings go up (other things being equal), so should stock prices. But that doesn’t always happen. Why? Even if earnings do rise, investors might not be willing to pay as much for those earnings, and declining valuations can more than offset that growth.

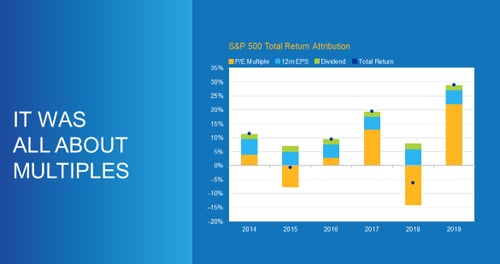

You can see this scenario illustrated in the chart below. Total returns for the S&P 500 come from earnings growth and valuation changes, as mentioned above, plus dividend payments. Over the past several years, earnings growth and dividends have accounted for a pretty steady 6 percent to 8 percent of growth. That growth, however, has been more than wiped out (in 2018) by a drop in what investors are willing to pay for those earnings, or it has been supercharged (in 2019) as investors suddenly bid up prices. In most years, it is not the fundamentals that drive returns but investor sentiment changing the valuations set on those fundamentals and, therefore, changing the prices.

P/E multiple is the price-to-earnings ratio; 12m EPS is the 12-month earnings per share.

Source: The Daily Shot, Bloomberg

Where are we now?

Which brings us to today. Right now, the economic fundamentals remain solid—although, of course, that may change—and corporate earnings are coming in better than expected. From a fundamental perspective, nothing has really changed yet. What has been driving prices up and down are the mood swings that change valuations. Those mood swings are dependent on the latest news and, therefore, are very volatile.

To try to determine whether the bull market will soon be over, we have to forecast two things: the fundamentals and investor sentiment. Ultimately, though, sentiment follows the fundamentals, so we are back to one factor. If we get the fundamentals right, over time we will also get the valuations—and the market—right. We saw this most recently at the end of 2018, when sentiment and valuations dropped only to recover as the fundamentals remained solid.

The recent drop in sentiment is due to fear that the coronavirus will hit the fundamentals, and hit them hard. If so, then all of the current damage (and more) is appropriate. But what if that doesn't happen?

Will the coronavirus spell the end of the bull market?

Based on what we know today, I don’t see the damage as being that extensive. First, when you look at the new cases, you can see that they are not exploding but are holding fairly steady around the world. If you look at the number of active infections, you can see that number dropping. The disease itself seems to be moving toward “under control” status.

That direction might change, of course, but the best place to look when trying to determine what is likely to happen is China itself. China is where the disease emerged first and where it is farthest along. In China, the disease seems to be largely under control. That does not mean we will not see more cases around the world. It does imply that control is both possible and achievable, which is substantially different from what the headlines are saying.

As investors, we can also look at China for what might happen in global markets. Here, the news is also encouraging. China’s CSI 300 Index is at a new 52-week high after recovering all of its losses from the coronavirus outbreak and then some. While you might say the Chinese market is manipulated, we also see a substantial recovery in the U.S.-based ETF that tracks the index, which closed yesterday within 2.5 percent of its 52-week high. Investors in China clearly think that any damage from the coronavirus will not be all that bad.

Given these facts, and the ongoing strength of the U.S. fundamentals, it looks to me to be premature to call for the end of the bull market. Unless this epidemic gets worse, and it might, signs are that this will be one more exaggerated obituary.

The real risk

The real risk, beyond the virus itself, will be the potential damage to consumer and business confidence. Here, again, the news remains good—but we will certainly be watching it. Big picture, however, the watchword for investors and the bull market remains keep calm . . . and carry on.

Print

Print