Recently, the number of questions I’ve been getting has been greater than usual. People are getting scared. It is not just about the pandemic, as that seems to be and is, at the moment, moving under control. Rather, people are worried about the election (and what that means for their portfolios), about the value of the dollar (and what that means for their portfolios), and about inflation (and what that means for their portfolios). The first concern comes up every four years, and the second and third are perennials, which appear whenever things look a bit dicey. No surprises here. But what is surprising is what’s missing: the questions about the federal deficit. This kind of uncertainty typically generates questions about what the deficit, and the debt, mean. Not this time.

Recently, the number of questions I’ve been getting has been greater than usual. People are getting scared. It is not just about the pandemic, as that seems to be and is, at the moment, moving under control. Rather, people are worried about the election (and what that means for their portfolios), about the value of the dollar (and what that means for their portfolios), and about inflation (and what that means for their portfolios). The first concern comes up every four years, and the second and third are perennials, which appear whenever things look a bit dicey. No surprises here. But what is surprising is what’s missing: the questions about the federal deficit. This kind of uncertainty typically generates questions about what the deficit, and the debt, mean. Not this time.

Where Are the Deficit Questions?

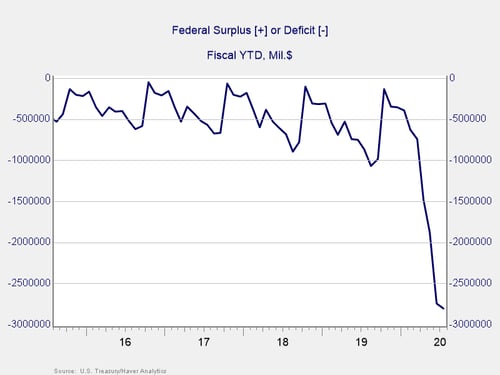

Here on the blog, I typically have written about the deficit in late summer (e.g., this post from summer 2018). You can see why in the following chart.

Toward the third quarter, historically, the deficit has started to swell, which generates headlines and fear. Then the deficit subsides again, and the headlines and fear go away. Historically, I have gotten questions and written something in the same time frame.

But that didn’t happen in 2019, and so far it hasn’t happened in 2020. There have been lots of questions about other things, but there hasn’t been enough concern about the deficit—or at least not enough to generate a lot of questions. This dearth is despite the fact that the deficit hit $1 trillion in 2019 and is now well on its way to $3 trillion. It’s not that the risks from the deficit have gone away. Quite the contrary. It isn’t even that people are focused on other things, like the pandemic, as that has not stopped the inflation and dollar questions. So, what is going on?

A Solvable Problem?

I suspect the reason has more to do with politics than economics. But, regardless of why, the fact that the deficit is much less an object of public fear is something that is starting to worry me. I have been saying for years that the deficit and the debt are a problem, but a solvable one. A base assumption of that conclusion, however, is that we collectively would at some point decide to solve the problem. That outcome is starting to look less likely.

In politics (and this is a political question), nothing happens until the pain of the solution is less than the pain of the problem. The pain of the solution, with spending cuts and tax increases, would be substantial. With no public concern about the deficit and debt raising the pain level of the problem, there will be no solution.

You can see this lack of concern in the policies from both sides. Recent trillion-plus deficits have come from the Republicans, while the Democrats support the idea that deficits don’t matter (a key tenet of Modern Monetary Theory). I am not sure where the constituency for the pain necessary to reduce the deficit, much less balance the budget, is going to come from. Maybe there simply isn’t one anymore, and that is the problem.

The Bus No One Is Watching

The bus you are looking for is not the one that hits you. Right now, investors are worried about the dollar and inflation. I am not, for reasons I have laid out elsewhere. I am getting increasingly worried, however, about the bus no one is watching: the deficit.

Fortunately, this is a slow-moving bus, and a collision is not imminent. But it is a bus we should all be watching. The more people are worried and the more questions I—and, hopefully, senators and congresspeople—get, the better I will feel.

Print

Print