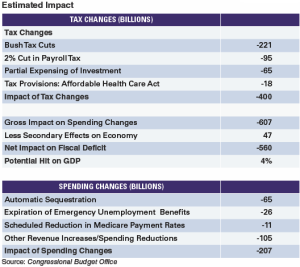

Once again, the papers lead with the fiscal cliff: “Pressure Rises on Fiscal Crisis” from the front page of the Wall Street Journal, “Congress Sees Rising Urgency on Fiscal Deal” from the New York Times, and “Schumer appeals to business on the fiscal cliff” in the Financial Times.

The good news is that everyone gets it, and both parties seem to feel a sense of urgency in dealing with this. Speaker Boehner has gone on record saying that additional revenue could be doable—which might be a concession, or might not. The President has been quoted saying he doesn’t think we will go off the cliff, but he hasn’t said why not.