— Guest post from Peter Essele, senior investment research analyst

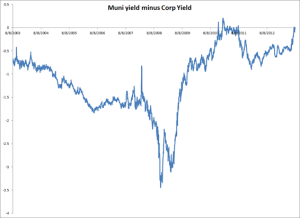

After the large uptick in rates and subsequent outflows from fixed income funds, the waters seem to have calmed recently, and investors are now beginning to move back into the space. One area, however, has continued to see outflows. While the taxable side of things only witnessed 4 weeks of outflows before a return to positive flows, the municipal bond category has recorded 13 straight weeks of outflows. Why is this happening?