The market’s movements continue to raise a lot of questions. After the decline to start the year and the ongoing recovery, does the market really have any idea where it’s going?

The market’s movements continue to raise a lot of questions. After the decline to start the year and the ongoing recovery, does the market really have any idea where it’s going?

In the short term, the answer is no.

Much like a dog racing around a field, the market runs away from things that scare it and toward things it likes. Recently, a lot of frightening things have popped up—an apparently slowing U.S. economy, sagging Chinese growth, and so forth—and the market has been running scared. If you’ve ever owned a dog, however, you know that it will eventually head for the food bowl. In this case, the food bowl is the U.S. economy.

Jobs: the heart of the economy

Changing up the metaphor a bit, I've mentioned before that the economy is the dog and the market the tail. The tail can certainly get going at times, but what really matters is the health of the dog, as the tail will end up following. Taking it a little further—okay, maybe too far—the job market is the heart of the dog (i.e., the economy). Without jobs, the dog dies. And no one wants that.

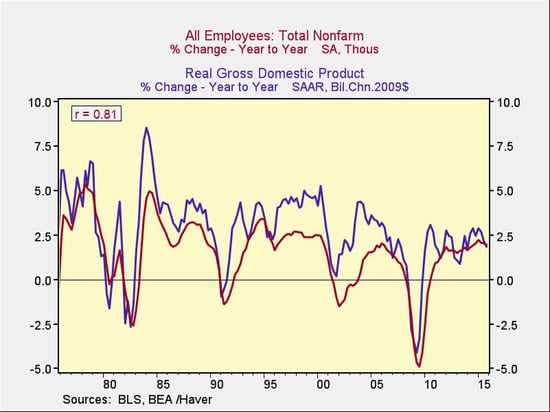

To step back from this overextended comparison, the economy and the job market are highly correlated. It makes sense: the economy depends on people spending money, which they largely get from their jobs. Changes in jobs are therefore a good predictor of where the economy is going, as you can see in the chart.

Jobs track the economy, and you don’t see economic trouble without a corresponding decline in jobs. You could say that, here, the economic growth rate is the tail to the job market, as it moves around much more violently than the actual job growth rate does, which has been especially apparent in the past couple of years. Job growth has been quite steady, and even as growth rates have changed, they still track job growth over time.

Strong economy reassures the market

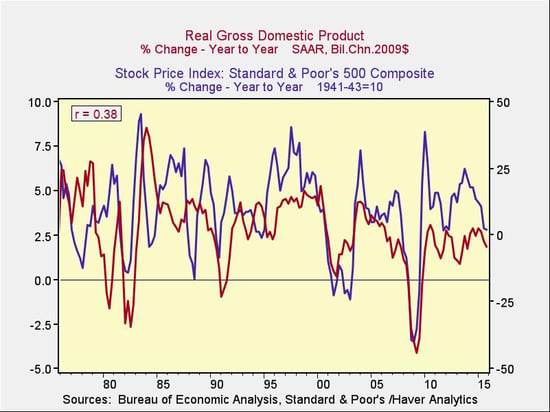

The market does indeed track the economy, just as jobs do. In the chart below, we see that the economy is still in a healthy range and, per the jobs data so far, likely to stay there.

Markets reacted to the fears about the economy, but those fears don’t seem to be playing out. Last month, the jobs report came in at a healthy level, and just last week, personal income and spending beat expectations by quite a bit. Jobs and earnings drive the economy, and the economy drives the markets. If the economy is solid, the markets may well recover—and that is what seems to be happening.

I have argued that the decline in prices over the past couple of months was due to a break in confidence. (A well-justified one, I might add, given all of the bad news.) Now that the economic numbers are looking better, however, and foreign governments are stepping up to handle some of their issues, confidence is returning—and so, by no coincidence, are stock prices.

If you only want to look at one economic statistic, use jobs. Jobs are the foundation of the economy and the markets, and right now, the foundation looks much more solid than the headlines might suggest.

Print

Print