Recent good news on confidence, spending, and wage growth is real, but it occurred to me looking at my recent posts that I’ve neglected something important: context. Let’s take a look at the bigger picture when it comes to wage growth.

Recent good news on confidence, spending, and wage growth is real, but it occurred to me looking at my recent posts that I’ve neglected something important: context. Let’s take a look at the bigger picture when it comes to wage growth.

Putting wages in perspective

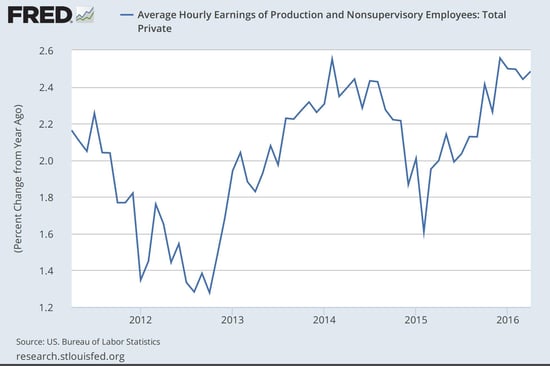

On a five-year basis, the upward trend is clear. After a decline in growth in 2013, the recovery in wages has been dramatic. This trajectory helps explain much of the earlier weakness in confidence and spending growth, as well as the recent acceleration. We can also see the more recent pullback in 2015, followed by an even faster recovery.

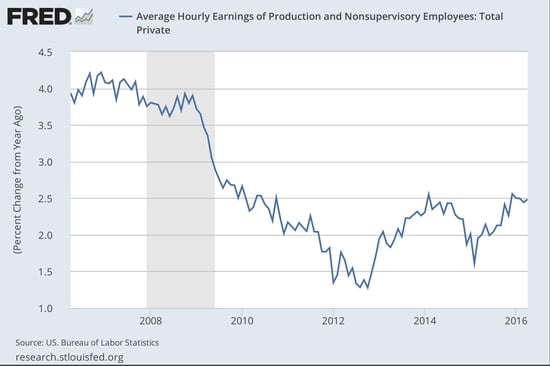

On a ten-year basis, however, the recovery looks less impressive. Wages are growing about 1.5 percent too slowly to replicate the mid-2000s. There’s clearly a long way to go yet, which constrains just how cheerful we can be.

On the other hand, it’s important to note that the sustained downturn—from the financial crisis to mid-2012—is over. We saw a substantial and reasonably quick recovery from 2012 through 2014. The subsequent 2015 weakness was short lived, and the bounce back has been reasonably quick. This is what you’d expect from a pullback driven not by systemic weakness in labor demand but by short-term factors such as, say, low oil prices and a strong dollar.

In other words, you can make a good case that the systemic wage recovery started in 2012, and that the recent pullback and recovery validate its strength. If the labor market was really weak, the slowdown in 2015 should have derailed it. Instead it bounced back quickly to about the highest level since the crisis.

A virtuous cycle

You can look at the fact that wage growth has a long way to go as a negative, and of course, in some ways, it is. But, on the positive side, you can also see that there’s plenty of room for wages to continue rising. Over the past couple of years, we've seen wage growth move up by about 1 percent per year on two occasions. If that pace persists, we’re about 18 months away from the wage growth levels we typically see in booms.

Put that way, current trends don’t seem so bad. The key will be whether or not another round of economic weakness or systemic factors drag growth down. At this point, that seems less likely, at least for the rest of the year, suggesting we may well see wage growth move back to post-crisis highs.

This is an essential part of the virtuous circle that drives economic growth: higher wages lead to more spending, which leads to faster growth, which leads back to higher wages. Conditions are as good as they have been since the crisis for that kind of self-sustaining process to start. In many ways, the quick recovery from the recent weakness suggests that’s just what will happen.

Print

Print