As I mentioned the other day, the past couple of years have seen a slowdown from a strong first quarter to a weaker second quarter, and it seems like this year will be no exception.

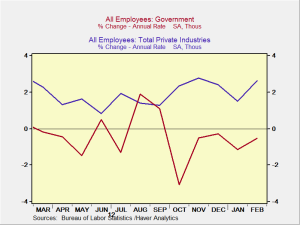

This morning’s employment reports were a serious disappointment. Job growth dropped across the board, with an increase of 88,000 in nonfarm payrolls—down from 268,000 in February and less than half the expected 190,000. Although the decline was partially offset by upward revisions in the previous months, there’s no denying this is a significant letdown. Adding to the bad news was a slowing in wage growth, from 2.1 percent to 1.8 percent on an annual basis, with wages staying flat month to month.