The big economic news of the week came in this morning: the jobs report.

The big economic news of the week came in this morning: the jobs report.

Despite a jump in business and consumer confidence since the election, some of the facts on the ground have been weaker. To spur on faster economic growth, that confidence needs to result in action. Fortunately, this morning’s jobs report suggests that it is.

Let’s start with the numbers:

- 156,000 jobs were created in December, below the 175,000 expected. The shortfall of 19,000 jobs was disappointing, but November was revised up by 26,000. So, on balance, we ended the year 7,000 jobs ahead of expectations.

- Average weekly hours worked remained constant, at 34.3, but in this case, November was revised down.

- The unemployment rate ticked up, from 4.6 percent to 4.7 percent, which is still a very low level indicative of full employment. More important, the underemployment rate dropped from 9.3 percent to 9.2 percent, showing continued improvement as people move more fully back into the working world.

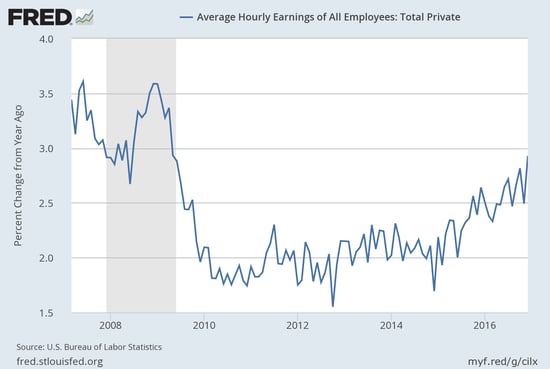

- Wage growth was up by 0.4 percent for the month, a big improvement over the surprising 0.1-percent decline in November. This takes annual growth up to 2.9 percent—a new post-crisis high and approaching pre-crisis levels (see the chart below). Wage growth has been lagging compared with other indicators, so this move is a very positive sign.

What does the jobs data mean for the economy going forward?

Again, the news is good. What we should expect if the economy continues to improve is, in fact, exactly what we are already seeing:

- As the unemployment rate drops, hiring should decrease simply because there are fewer people available.

- With fewer people available, wage growth should accelerate.

- This should pull more people into the labor force and make more intensive use of the ones already there.

In other words, the data is entirely consistent with an economy approaching normal status. Normal, remember, is what we’ve been trying to get to for years, and as the Fed’s recent minutes essentially said, we’re pretty much there. This jobs report confirms that assessment.

A more normal economy in 2017

In the year ahead, then, we can probably expect to see these trends continue. Companies will create jobs, but they will have a tougher and tougher time filling them. They will be forced to raise wages and hire more marginal candidates, expanding the labor force and increasing spendable income. Those people, in turn, will become more confident and go out and spend.

In short, everything we have seen so far, but at an accelerating pace.

The concern here is that the improvements, both in confidence and in the facts on the ground, won’t translate into actual growth. This is a real risk, and one we have seen repeatedly over the past several years. Still, signs are good that recent increases in confidence—and the fact that wage growth is finally breaking out—may bring on the economic acceleration we’ve been waiting for.

Print

Print