My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Market Risk Update. Thanks for the assist, Sam!!

My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Market Risk Update. Thanks for the assist, Sam!!

Markets continued to rally into the end of the year, with strong December results wrapping up a solid year for equities. The S&P 500 gained 3.17 percent during the month as the Dow Jones Industrial Average gained 3.41 percent and the Nasdaq Composite rose by 5.71 percent. Despite the strong returns in December to cap off the year, markets still face very real risks.

Recession Risk

Recessions are strongly associated with market drawdowns. Indeed, 8 of 10 bear markets have occurred during recessions. As we discussed in this month’s Economic Risk Factor Update, the National Bureau of Economic Research declared that a recession started in February. On top of that, most of the major economic indicators we cover monthly remain at concerning levels, despite continued economic recovery during the month. As such, we have kept the economic factors at a red light for January.

Economic Shock Risk

One major systemic factor is the price of money, otherwise known as interest rates. This drives the economy and financial markets and has historically had the ability to derail them. Rates have been causal factors in previous bear markets and deserve close attention.

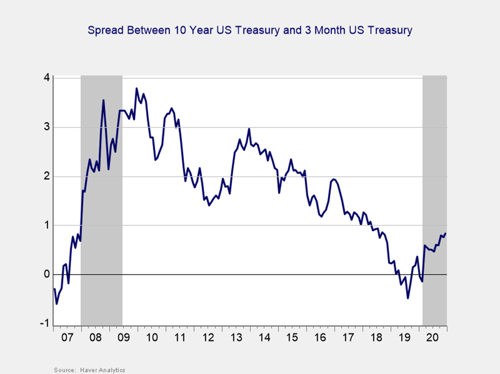

Risk factor #1: The yield curve (10-year minus 3-month Treasury rates). We cover interest rates in the economic update, but they warrant a look here as well.

The yield curve started the year inverted, and it un-inverted in March, where it has remained throughout the pandemic. This un-inversion was driven by a sharp drop in short-term rates, which was caused by the Fed’s decision to cut the federal funds rate to effectively 0 percent in March. The yield of the 3-month Treasury rose modestly in December, from 0.08 percent at the start of the month to 0.09 percent at month-end. The 10-year yield also rose during the month, from 0.84 percent in November to 0.93 percent in December, driven in large part by rising expectations for additional federal stimulus spending during the month.

Although the rate differential remains in the recession zone, it is approaching the level that is historically a sign of a recovery. While that is a positive for the economy, it would also indicate rates are likely to keep moving higher, which may have a negative impact on stocks. In light of that, and with the spread remaining in the recession zone, we are leaving this indicator at a red light.

Signal: Red light

Market Risk

Beyond the economy, we can also learn quite a bit by examining the market itself. For our purposes, two things are important:

- To recognize what factors signal high risk

- To try to determine when those factors signal that risk has become an immediate, rather than theoretical, concern

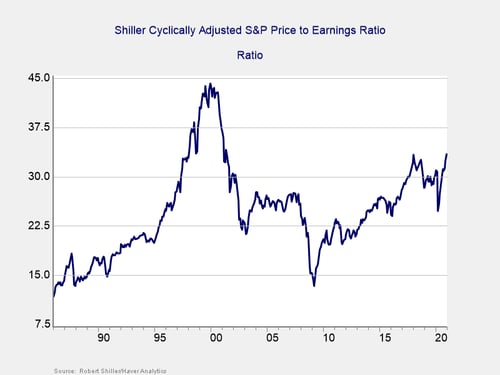

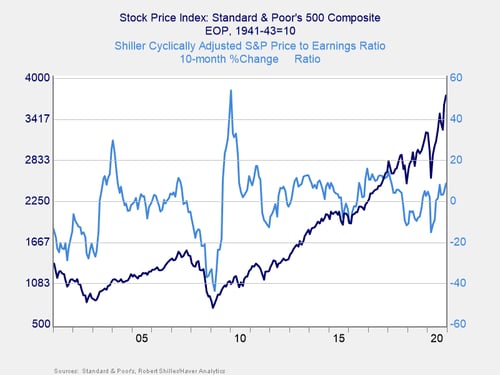

Risk factor #1: Valuation levels. When it comes to assessing valuations, we find longer-term metrics—particularly the cyclically adjusted Shiller P/E ratio, which looks at average earnings over the past 10 years—to be the most useful in determining overall risk.

Valuations continued to rise in December, with the S&P 500 rally bringing the Shiller CAPE ratio up from 32.4 in November to 33.4 in December. This brings valuations to their highest level since the dot-com bubble, as the CAPE ratio ended the month above the previous high-water mark of 33.3 that was set in January 2018.

Even as the Shiller P/E ratio is a good risk indicator, it is a terrible timing indicator. To get a better sense of immediate risk, we can turn to the 10-month change in valuations. Looking at changes, rather than absolute levels, gives a sense of the immediate risk level, as turning points often coincide with changes in market trends.

Here, you can see that when valuations roll over, with the change dropping below zero over a 10-month or 200-day period, the market itself typically drops shortly thereafter. This relationship held last March, as valuations and the index both rolled over before rebounding. On a 10-month basis, valuations rose by 8.8 percent in December, up from a 4.6 percent increase in November. Given the historically high valuation levels, we have kept this indicator as a yellow light for now despite the fact that valuation changes have remained outside of the danger zone for the past six months.

Signal: Yellow light

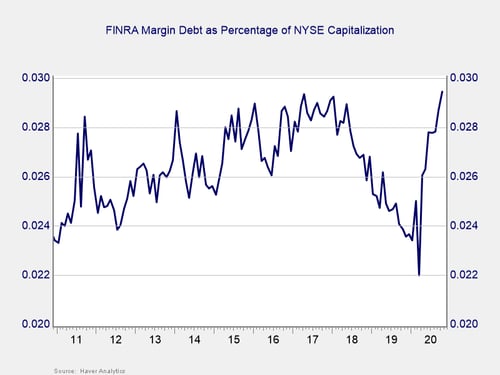

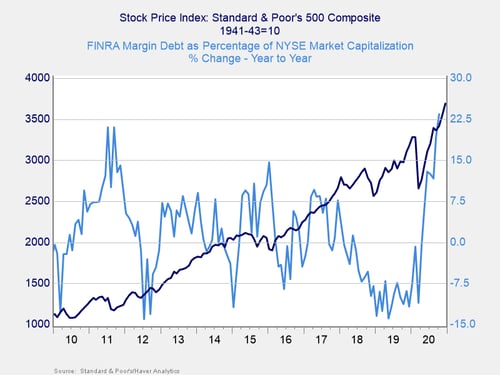

Risk factor #2: Margin debt. Another indicator of potential trouble is margin debt.

Debt levels as a percentage of market capitalization had dropped substantially over the past two years before spiking at the end of last year to a multi-year high. The high level of debt associated with the market is a risk factor on its own but not necessarily an immediate one.

For immediate risk, changes in margin debt over a longer period are a better indicator than the level of that debt. Consistent with this, if we look at the change over time, spikes in debt levels typically precede a drawdown.

As you can see in the chart above, October’s debt level increased by 23.4 percent on a year-over-year basis, up from an already high 19.2 percent increase in September, which indicates that risks are rising. This marks the largest increase in margin debt since February 2008, when year-over-year debt levels increased by 28 percent. Given the increase in debt on both a monthly and yearly basis, and the fact that the overall debt level remains historically high, this risk is rising, and we have kept this indicator at a red light.

Signal: Red light

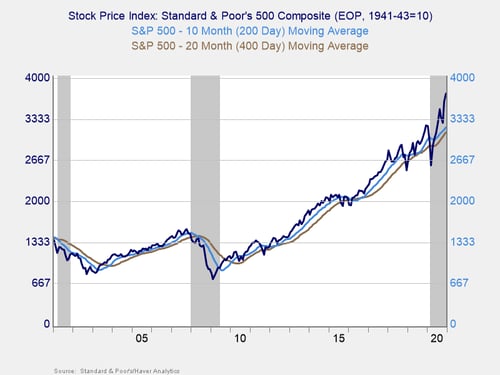

Risk factor #3: Technical factors. A good way to track overall market trends is to review the current level versus recent performance. Two metrics we follow are the 200-day and 400-day moving averages. We start to pay attention when a market breaks through its 200-day average, and a break through the 400-day often signals further trouble ahead.

Technical factors remained supportive for equity markets in December. The S&P 500, which managed to break above its 200-day moving average at the end of May, finished above trend for the eighth month in a row. This also marks six straight months with all three major indices finishing above trend.

The 200-day trend line is an important technical signal that is widely followed by market participants, as prolonged breaks above or below this trend line could indicate a longer-term shift in investor sentiment for an index. The 400-day trend line is also a reliable indicator of a change in trend. The continued technical support for markets in December was encouraging, so we have left this signal at a green light for the month.

Signal: Green light

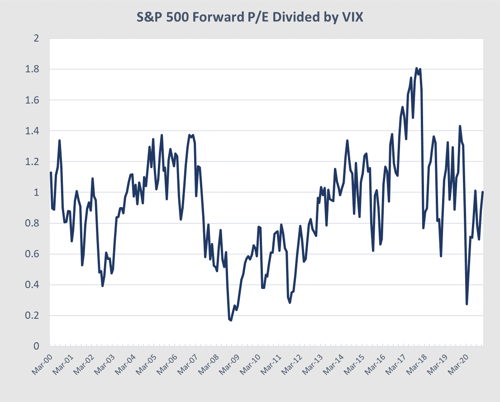

Risk factor #4: Market complacency. This is a recently added risk factor that aims to capture a standardized measure of market complacency across time. Complacency can be an uncertain term, so this chart aims to identify and combine two of the common ways to measure complacency: valuations and volatility.

For the valuation component of the index, we are using the forward-looking price-to-earnings ratio for the S&P 500 over the next 12 months. This gives an idea of how much investors are willing to pay for companies based on their anticipated earnings. Typically, when valuations are high, it signals that investors are confident and potentially complacent. For volatility, we have used the monthly average level for the VIX, a stock market volatility index. When volatility for the S&P 500 is high, the VIX rises, which would signal less complacency.

By combining the two metrics in the chart below, we see periods where high valuations and low volatility have caused peaks, such as 2000, 2006 to 2007, and 2017. We saw market drawdowns roughly within a year following each of these peaks.

Looking at the current market, it appears as if complacency is rising but is not yet at dangerous levels. While valuations have rebounded along with the market, there has been enough volatility to cause the VIX to remain elevated compared to pre-pandemic levels. The rebound in markets in December caused valuations to rise and the VIX to fall for the second month in a row, but December’s average VIX of 22.4 is still higher than the 2020 low of 13.9 that was seen in January. The index’s current level of 1.0 is still below the 1.2 level that has historically shown high levels of complacency in the market.

We are keeping this indicator at a green light due to the fact that the index still sits below the historical trouble level and that the VIX remains above the recent lows despite the rally in December. If this trend continues, however, this may become an area worth monitoring.

Signal: Green light

Conclusion: Market Risks Remain Despite Continued Rebound in December

Economic fundamentals showed continued growth in December, but the pace of the recovery slowed compared to earlier in the year. Markets continued to rally into the end of the year, with the strong December performance capping off a solid year for equities. While the pandemic remains a risk for the economy and markets, mass vaccination efforts have begun, which should help us combat the medical risks in the medium to long term. Additionally, the federal stimulus announced at the end of 2020 should help the economy weather the risks in the short term.

Given the continued risk posed by the pandemic, we are keeping the overall market risk indicator at a red light for now, although an upgrade to a yellow light is looking increasingly possible. The road back to normal is likely going to be long with the potential for setbacks that could lead to additional market pullbacks. Given the uncertainty created by the pandemic and the possibility for further volatility, investors should remain cautious on equity markets.

Print

Print