My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

The economic recovery continued in April, driven by improvements on the public health front and the lingering tailwind from the most recent federal stimulus bill. Consumer confidence surged during the month, highlighting increased optimism from consumers for a return to more normal economic conditions throughout the year. Service sector confidence fell slightly in April but remains near record territory. The weakest data point was employment, with April’s employment report showing a significant drop in job growth. Although it marked four consecutive months with job growth, the drop called into question how sustainable recent job growth might be.

We’ve kept the overall economic risk level at yellow for now, largely due to the weak jobs report, but an upgrade to green remains possible in the upcoming months. Although we have made progress in terms of containing the pandemic, there is still real work that needs to be done to get economic activity back to pre-pandemic levels, and the uncertain path back to normal indicates that economic risks remain.

The Service Sector

Signal: Green light

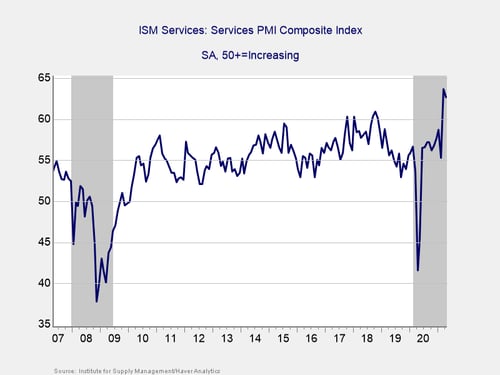

Service sector confidence fell modestly from 63.7 in March to 62.7 in April against forecasts for an increase to 64.1. Despite the modest decline from March’s record high, this represents the second-highest level for the index on record. This is a diffusion index, where values above 50 indicate expansion, so the report showed that the service sector continued to grow at a healthy pace during the month.

Service sector confidence has rebounded well since initial lockdowns were lifted last year, and this strong result in April indicates that continued growth is expected in the months ahead. The improvements on the public health front and the associated easing of state and local restrictions have helped support high levels of service sector confidence for the past two months. These trends are expected to continue as we make progress with vaccinations.

Given the strong result in April and the fact that service sector confidence remains near record highs and well above pre-pandemic levels, we have left this indicator at a green light.

Private Employment: Annual Change

Signal: Yellow light

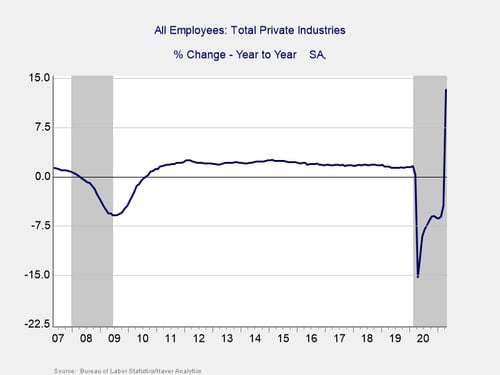

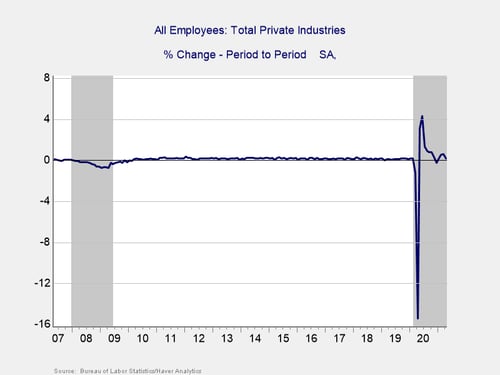

April’s employment report showed that the economy added 266,000 jobs during the month, marking four straight months of job growth. April was down significantly from the already downwardly revised 770,000 jobs that were added in March, however. This was also well below economist estimates for an additional 1,000,000 jobs to be added in April. The hard-hit leisure and hospitality sectors continued to see gains due to the easing of state and local restrictions, but declines in other areas and a pullback in temporary worker and transportation jobs held back overall job growth.

The underlying data showed signs of continued stress on the labor market, as the unemployment rate increased from 6 percent in March to 6.1 percent in April. While April saw year-over-year job growth surge by 13.3 percent, this was primarily due to the large decline in jobs last April when initial lockdowns were implemented. Total employment remained down by 4.2 percent in April compared with March 2020.

While the continued job growth during the month was a positive development, and supporting data suggests this weak report is an anomaly, the large slowdown in the pace of hiring indicates that risks remain and that we have a long road back to pre-pandemic employment levels. Therefore, we have left this indicator at a yellow light for now.

Yield Curve (10-year Minus 3-Month Treasury Rates)

Signal: Green light

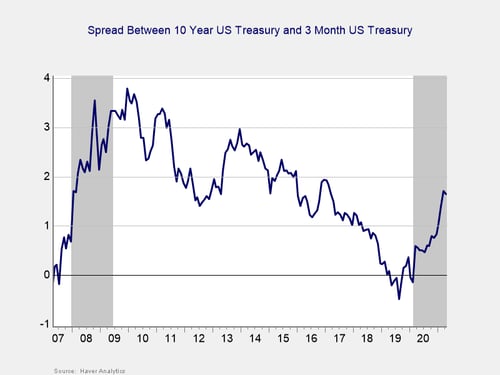

The yield curve narrowed slightly during the month, marking the first time that the curve has flattened in a month since last November. The flattening was driven by a decline in long term-interest rates. The 10-year Treasury yield fell from 1.74 percent at the end of March to 1.65 percent at the end of April, while the 3-month yield fell from 0.03 percent to 0.01 percent. Although short-term rates are expected to remain low until at least 2023, longer-term rates now sit near pre-pandemic levels, reflecting a normalization of growth expectations as economic conditions continue to improve.

Given the normalization of long-term interest rates and the expectation for short-term rates to remain low, the yield curve should hover near levels that have historically signaled a recovery. Therefore, we have kept this signal at green light, reflecting the positive impact from the continued economic recovery on rates.

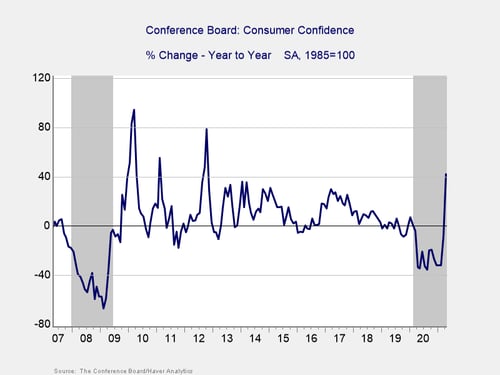

Consumer Confidence: Annual Change

Signal: Green light

Consumer confidence continued to improve by more than expected in April, with the index rising from 109 in March to 121.7 in April against calls for a more modest increase to 113. This result brought the index to its highest level since initial lockdowns last year and marks four consecutive months with improved consumer sentiment. Confidence has recently been supported by improvements on the public health front, additional rounds of federal stimulus, and continued job growth.

While the 42 percent year-over-year increase in confidence was largely due to a sharp drop in confidence last April, the recent improvements for the index have brought confidence back near pre-pandemic levels. Historically, declines in confidence of 20 percent or more over the past year are a signal of a recession, so the improvement in the year-over-year data in the past two months has been very encouraging—even if it is largely due to comparisons to last March and April, when initial lockdowns were announced and confidence swiftly declined.

Given the improvement for consumer confidence on both a monthly and year-over-year basis in April, we have upgraded this indicator to a green light. Looking forward, continued job growth and progress on the vaccination front should help to support high levels of consumer confidence and spending growth.

Conclusion: Continued Growth Remains Most Likely Path Forward

The economic data releases in April largely pointed toward continued growth in the months ahead; however, there were signs that the economy is still felling the negative effects from the pandemic. The disappointing April jobs report highlights the continued stress on the labor market and indicates that the path back to normal is still long and that setbacks along the way can be expected. With that said, the high levels of consumer and business confidence show that continued growth remains the most likely path forward.

While there are reasons for optimism as we head into the summer, for the time being, the economy is facing stress from the pandemic, and there is uncertainty regarding the path and pace of the recovery throughout the rest of the year.

Given this uncertainty and the continued stress on the labor market, it’s too early to say we are back to normal, even if continued growth is the most likely path forward. The positive progress in April was encouraging and allowed for upgrades to one of the indicators this month. We have left the overall economic risk indicator at a yellow light for now, with the prospect for an upgrade in the coming months if we continue to see improvements.

Print

Print