My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

The economic reports released last month showed continued growth as the momentum from 2021 carried over into 2022 despite the shifting risks to start the year. The February employment report showed a continued acceleration in hiring, which was an encouraging signal that the economic recovery remains strong. While we saw service sector and consumer confidence drop somewhat due to rising concerns surrounding inflation and the Russian invasion of Ukraine, they still remain well within expansionary territory.

On the medical side, daily new case growth fell notably in February. Average daily new cases ended the month at their lowest level since July 2021, as high levels of vaccination and natural immunity from previous exposures helped contain the spread of the Omicron variant. Overall, the recent wave's medical risks, and their economic impact, appear to be behind us.

Despite the ongoing improvements, the risks from both inflation and the consequences of the Russian invasion of Ukraine haven't had time to fully show up in the data, and we have left the overall risk level at a yellow light for now. That said, if we see the war risks decline in the short term, the economic momentum could lead to quick upgrades in the months ahead.

The Service Sector

Signal: Yellow light

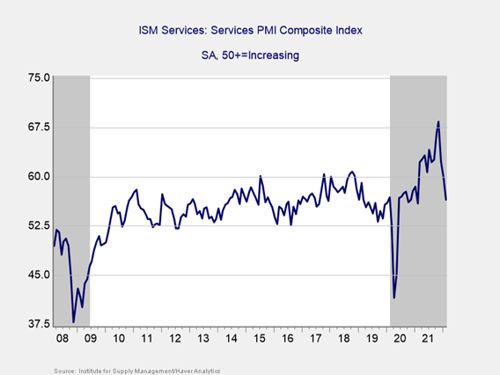

Surprisingly, service sector confidence dropped in February, as the ISM Services index fell from 59.9 in January to 56.5 in February against calls for an increase to 61.1. This brought the index to its lowest level since February 2021. This is a diffusion index where values above 50 indicate growth, so this result still signals continued expansion.

As you can see in the chart above, service sector confidence remains well above the lows from initial lockdowns and near pre-pandemic levels despite the larger-than-expected drop during the month.

While confidence remains in expansionary territory, the recent declines are a potential cause for concern, especially if we see another drop in the months ahead. Given these declines, we have left this indicator as yellow for now, with a potential downgrade possible if we see further drops.

Private Employment: Annual Change

Signal: Green light

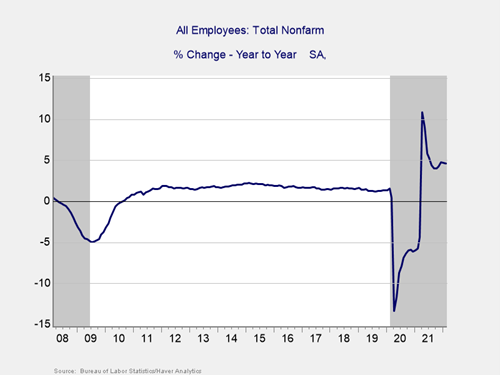

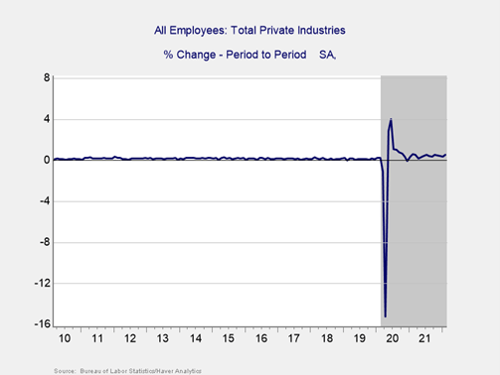

February’s employment report showed that 678,000 jobs were added during the month, well above the 423,000 additional jobs that were expected. The December and January job reports were also revised up by an additional 92,000 jobs. The better-than-expected February result and the positive revisions to past reports indicate that the labor market recovery continued at a healthy pace at the end of 2021 and at the start of 2022 despite the shifting risks over the past few months.

The underlying data was also encouraging. The unemployment rate fell from 4 percent in January to 3.8 percent in February, which marks a new low since the start of the pandemic. Labor force participation also increased by more than expected during the month, which was an encouraging sign that folks continued to renter the workforce.

Given the better-than-expected results in February and positive revisions to the previous job reports, we have kept this signal at a green light for now.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

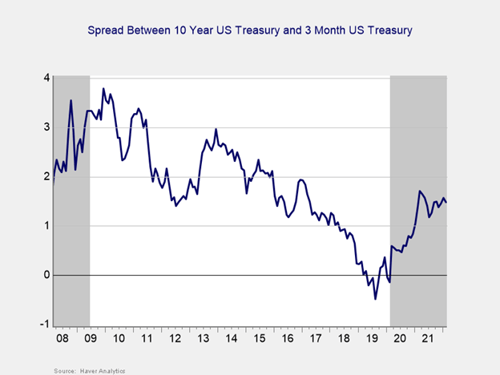

The yield curve flattened slightly in February. This result was primarily caused by rising short-term interest rates, as the 3-month Treasury yield increased from 0.22 percent at the end of January to 0.35 percent at the end of March. This increase was more than enough to offset a relatively smaller rise in long-term rates during the month. The 10-year Treasury yield increased from 1.79 percent at the end of January to 1.83 percent at the end of February. The rise in both short- and long-term yields was primarily due to rising expectations for a rate hike at the Fed’s next meeting in March, due to high levels of consumer and producer inflation.

Economists expect to see the Fed focused on combatting inflation in 2022, which could lead to more frequent rate hikes as the central bank tries to normalize monetary policy. While tighter monetary policy could lead to some market volatility, it is an encouraging signal that the Fed views the economy as healthy enough to endure a faster return to normal.

Given the fact that the spread between the 3-month and 10-year Treasury rates remains near September and October levels and well outside of the historical inversion danger zone, we have left this signal at a green light for now.

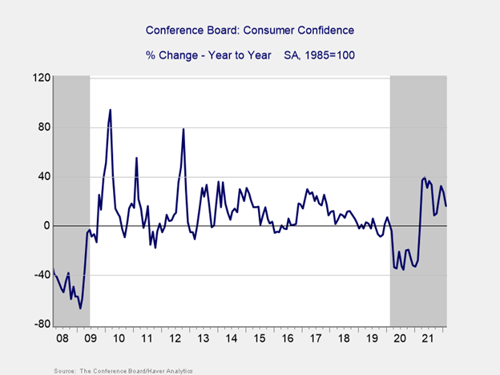

Consumer Confidence: Annual Change

Signal: Green light

Consumer confidence declined by less than expected in February. The Conference Board Consumer Confidence Index fell from a downwardly revised 111.1 in January to 110.5 in February against calls for a drop to 110. On a year-over-year basis, confidence increased 16.1 percent in February, which is down from the 27.6 percent increase we saw in January.

Historically, declines in confidence of 20 percent or more over the past year are a signal of a recession; the fact that the growth rate remained high in February was encouraging because it kept the year-over-year figure outside the historical danger zone.

Since confidence remains above the 2021 low of 87.1 and outside the danger zone on a year-over-year basis, we have left this indicator at a green light for now, although further declines in the months ahead could lead to a downgrade.

Conclusion: Economic Fundamentals Remain Solid

The economic data releases for February painted a picture of continued growth despite concerns about inflation and the Russian invasion of Ukraine. Looking forward, further economic growth remains the most likely path forward; however, as we’ve seen throughout the pandemic, there are real risks that remain in this outlook.

The accelerated hiring growth during the month was good news, but it’s still too early to say the job market is back to full pre-pandemic levels. The declining service sector and consumer confidence should also be monitored going forward. Ultimately, the pace and path of the expected recovery in the short term remain uncertain. Therefore, caution is still warranted.

We have left the overall economic risk indicator at a yellow light to reflect continued uncertainty and the potential for new setbacks in the months ahead.

Print

Print