My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

The economic recovery picked up steam in May, driven by continued improvements on the public health front and ongoing reopening efforts across the country. Improving business confidence was a highlight, as service sector confidence set a record high. The May employment report showed that the pace of hiring accelerated following a lull in April, although headline job growth came in below economist estimates.

We’ve kept the overall economic risk level at yellow for now, but an upgrade to green remains possible in the upcoming months if we continue to see the pace of hiring increase. While we have made progress with the pandemic, there is still real work to be done to get economic activity back to pre-pandemic levels. The uncertain path back to normal indicates that economic risks remain.

The Service Sector

Signal: Green light

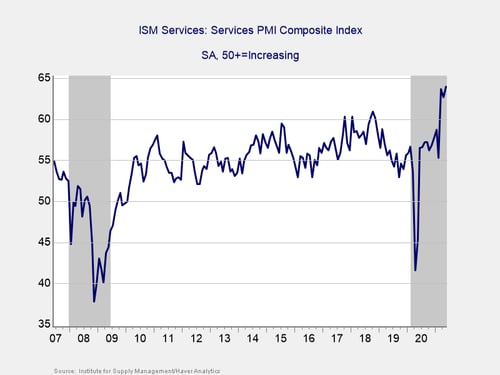

Service sector confidence improved by more than expected in May, as the index increased from 62.7 in April to 64 in May against calls for a more modest increase to 63.2. This result brought the index to its highest level since records began in 1997. This is a diffusion index, where values above 50 indicate expansion, so the report showed that the service sector continued to grow at a strong pace.

Service sector confidence has rebounded well since suffering from a largely weather-driven decline in February, and the index has now remained well above pre-pandemic levels for three straight months. Service sector confidence has been supported by public health improvements and the associated easing of state and local restrictions that has given business owners more confidence in the ongoing economic recovery. High levels of service sector confidence are a good sign for business investment and hiring, as improved confidence has historically supported faster spending growth.

Given the better-than-expected result in May and the fact that service sector confidence is at record highs and well above pre-pandemic levels, we have left this indicator as a green light.

The Jobs Market

Signal: Yellow light

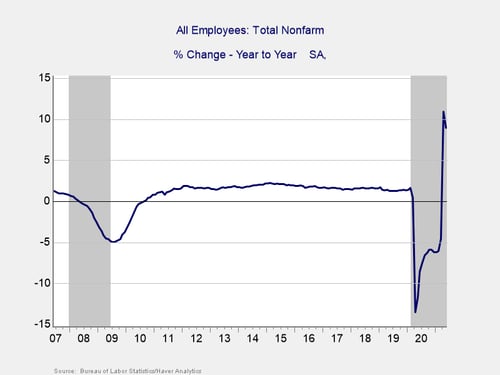

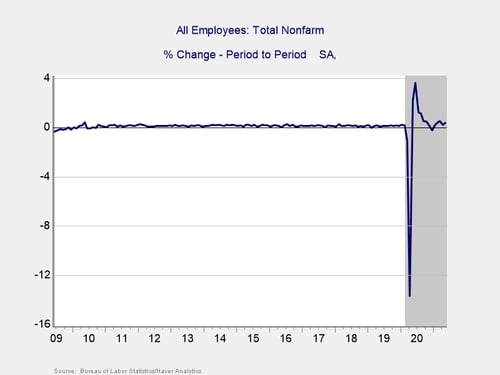

May’s employment report showed that the economy added 559,000 jobs during the month. This result was a noted improvement from the 278,000 jobs that were added the month before but below economist estimates for 675,000 additional jobs. This solid result marks five straight months with job growth following a temporary lull in hiring last December. The hard-hit leisure and hospitality sector saw some of the largest gains during the month due to the continued easing of state and local restrictions that allowed more businesses to reopen and hire employees to meet rising consumer demand.

The underlying data also showed signs of improvement, but there is still work to be done, as the unemployment rate declined from 6.1 percent in April to 5.8 percent in May. While May saw year-over-year job growth increase by 8.9 percent, this was primarily due to the large decline in jobs that we saw last spring when initial lockdowns were implemented. The total number of jobs across the economy remains down by more than 7.6 million compared with pre-pandemic peak levels.

Although the continued job growth during the month was a positive development, it would take more than a year of hiring at the same pace as May to get back to pre-pandemic employment levels. Given the decline in overall employment compared with the pre-pandemic peak, we have left this indicator at a yellow light for now, with an upgrade to green possible in the months ahead if we continue to see accelerated job growth.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

The yield curve narrowed slightly for the second month in a row. The flattening in May was driven by a decline in long-term interest rates. The 10-year Treasury yield fell from 1.65 percent at the end of April to 1.58 percent at the end of May. The 3-month Treasury yield remained unchanged at 0.01 percent. While short-term rates are expected to remain low until at least 2023, longer-term rates now sit near pre-pandemic levels, reflecting a normalization of growth expectations as economic conditions improve.

Given the normalization of long-term interest rates and the expectation for short-term rates to stay low, the yield curve should remain near levels that have historically signaled a recovery. We have therefore kept this signal at green light, reflecting the positive impact from the continued economic recovery on rates.

Consumer Confidence: Annual Change

Signal: Green light

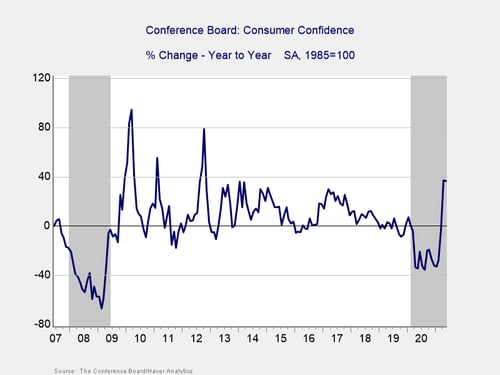

Consumer confidence dropped modestly in May, with the index falling from a downwardly revised 117.5 to 117.2, against calls for an increase to 118.8. Despite the decline, this result still represents the second-highest level for the index since the start of the pandemic. The drop in May was largely driven by rising concerns about inflation, but the index remains at healthy levels that should continue to support consumer spending growth. Confidence has recently been supported by improvements in public health, additional rounds of federal stimulus payments, and continued job growth.

Although the 36.4 percent year-over-year increase in confidence was largely due to a sharp drop in confidence last May, the recent improvements for the index have brought confidence back near pre-pandemic levels. Historically, declines in confidence of 20 percent or more over the past year are a signal of a recession, so the recent improvement in the year-over-year data in the past two months has been very encouraging, even if it is largely due to comparisons to last spring when initial lockdowns were announced and confidence swiftly declined.

Given the fact that confidence has now returned to near pre-pandemic levels and remains strong on a year-over-year basis, we have left this indicator at a green light for now. Looking forward, continued job growth and progress on the mass vaccination front should help support high levels of consumer confidence and spending growth as we head into the summer months.

Conclusion: Economy Poised for Continued Growth

The economic data releases from May largely pointed to continued growth in the months ahead, but there are signs that the recovery still faces headwinds created by the pandemic. Although we’ve made progress in getting people back to work over the past year, we still have a long way to go to return to pre-pandemic employment levels. As we saw in April, the pace of hiring can be volatile on a month-to-month basis, so the potential path back to normal for the job market remains uncertain. With that said, the other factors that we track on a monthly basis continue to point toward sustained growth over the next few months.

While continued growth remains the most likely path forward, it’s too early to say we are back to normal. The high levels of business and consumer confidence should continue to support additional spending growth; however, risks remain that could cause uncertainty about the path and pace of the expected recovery.

The continued improvement in May was encouraging, and we have left three of the four indicators at a green light for now, with a future upgrade in the labor market possible if we continue to see accelerated job growth. We have therefore left the overall economic risk indicator at a yellow light for now, which may get an upgrade in the coming months if we continue to see improvements.

Print

Print