The data for June was generally positive, with a rebound in job growth and a surprise increase in business confidence supported by continued high levels of consumer confidence. After a run of weak data in the past couple of months, the June rebound is a good sign. Although there is still a gap between confidence and actual hard data, the persistence of confidence suggests that most economic factors remain positive—and that the current expansion is likely to continue.

The Service Sector

Signal: Green light

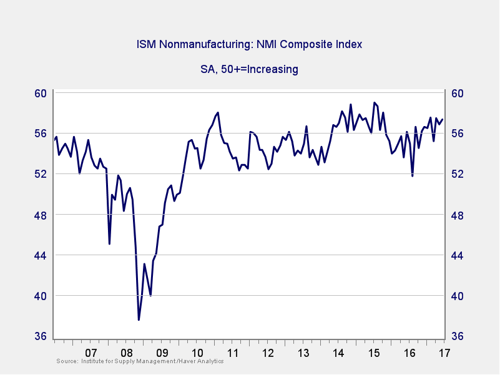

The ISM Nonmanufacturing Index surprised by rising in June, despite expectations of a small decline. This increase offset a modest decline in May. As a diffusion index, readings above 50 indicate expansion, and readings below 50 indicate contraction. After some weakness in late 2016, this index has registered increasing business confidence, so it remains a green light.

Private Employment: Annual Change

Signal: Green light

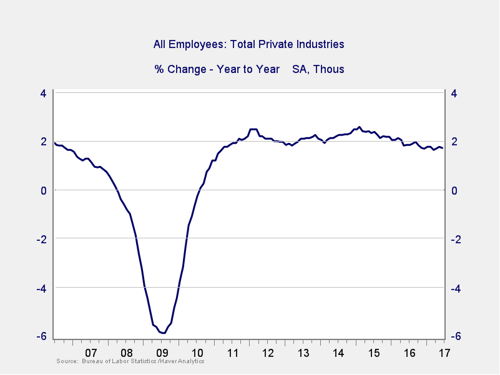

June job creation beat expectations, with 222,000 jobs added against expectations of 178,000. In addition, May’s disappointing results were revised up to a healthy 152,000 new jobs. The underemployment and unemployment rate both ticked up slightly during the month, but even this was positive, as the increases were driven by a bump in the labor force participation rate.

Because this is an annual figure, changes are slower and smaller than those we see in more frequently reported data. The major thing to watch here is the trend, which indicates slowing job growth over time. Despite the slowing trend, job growth is still quite positive overall, so this indicator remains a green light.

Private Employment: Monthly Change

Signal: Green light

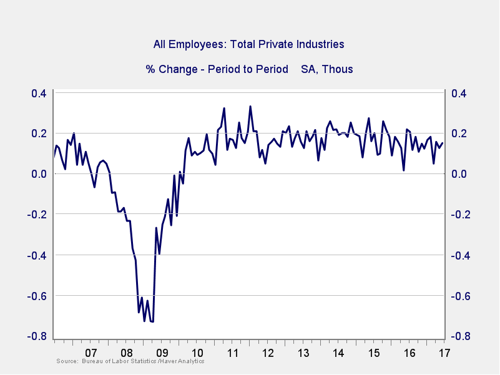

These are the same numbers as in the previous chart but on a month-to-month basis, which can provide a better short-term signal.

The positive results in June were welcome given monthly volatility in this measure to start the year. The labor market appears to be relatively healthy given the low levels of job openings and high levels of voluntary exits, which are often associated with tight labor conditions. While we will continue to monitor the headline job creation numbers, June’s healthy results, and the continued strength of the longer-term numbers, indicate that the overall employment situation remains a green light.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

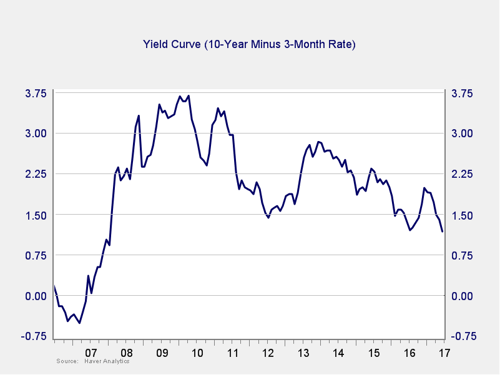

The yield curve flattened further in June. This was driven by lower inflation data that depressed the intermediate and long portions of the curve, as well as the Fed’s decision to raise short-term rates in mid-June. The Fed’s decision was widely seen as validation of the strength of the economy; however, the increase in the short-term rates flattened the yield curve to levels not seen since early 2008.

Although the spread between the 10-year and 3-month rates remains well outside of the risk zone, the fact that it is now at post-crisis lows suggests that caution is warranted. I am leaving this measure at green for now, but I will be keeping an eye on it given the downward trend.

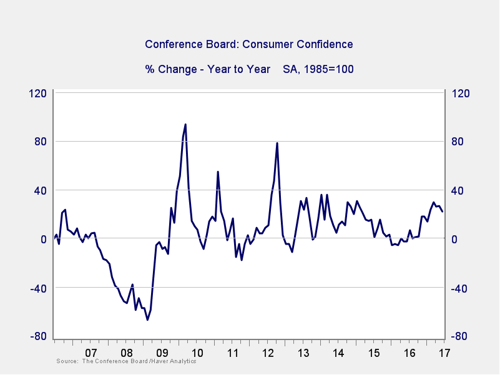

Consumer Confidence: Annual Change

Signal: Green light

Consumer confidence increased slightly in June, following decreases in the previous two months, and remains near 16-year highs. This high level of consumer confidence bodes well for second-half growth. On an annual basis, the trend is also positive, with a significant increase over that time. Overall, this measure is a green light.

Conclusion: Economy healthy, positive trends improve

Continued high levels of consumer and business confidence support expectations for future growth, while a strong jobs report suggests that the hard data may be improving as well. Although there are some concerns over trends in the data, as well as weaker reports earlier in the year, the economy remains on track overall, and we conclude at a green light for this month.

Print

Print