My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

Despite rising medical risks during the month that caused some uncertainty, the economic recovery continued full steam ahead in December. Business confidence ended the year in healthy expansionary territory, supported by high levels of consumer demand during the important holiday season. Consumer confidence improved during the month, which was an encouraging signal that consumers remained willing and able to spend in December despite the rising medical risks. Finally, while we saw hiring slow in December, the underlying data showed notable improvements in the household survey of workers.

On the medical side, risks increased during the month due to the rapid spread of the Omicron variant. While we saw case growth set new highs in December, high levels of vaccination and natural immunity from previous exposures have caused hospitalizations to lag case growth in the current wave. While the medical risks are real and certainly worth monitoring, at this time, the impact on the economy remains muted compared to earlier waves.

Given rising medical risks during the month and the continued slowdown in headline job creation, we’ve left the overall economic risk level at yellow for now; however, on the whole, the economic environment is much better than it was at the start of last year, highlighting the very real improvement that we made in 2021.

The Service Sector

Signal: Green light

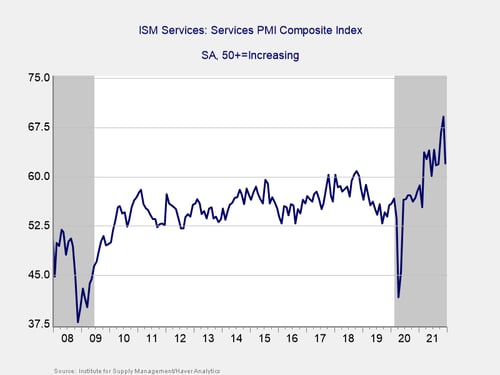

Service sector confidence declined by more than expected in December. The ISM Services index fell from 69.1 in November to 62 in December against calls for a more modest drop to 67. Despite the larger-than-expected decline during the month, this result still represents a healthy level of growth for the service sector, as this is a diffusion index where values above 50 indicate expansion.

As you can see in the chart above, service sector confidence remains well above the lows from initial lockdowns and pre-pandemic levels. Service sector confidence was supported throughout 2021 by public health improvements and the associated easing of state and local restrictions that reassured business owners of the health of the ongoing economic recovery. Historically, high levels of business confidence have supported more business spending and output, so this strong result to end the year bodes well for business spending to start 2022.

Given that service sector confidence remains well above pre-pandemic levels, we have left this indicator at a green light for now.

Private Employment: Annual Change

Signal: Yellow light

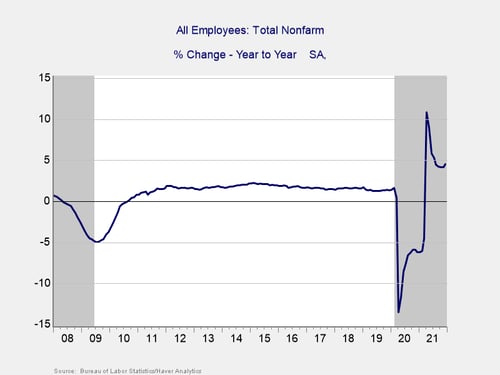

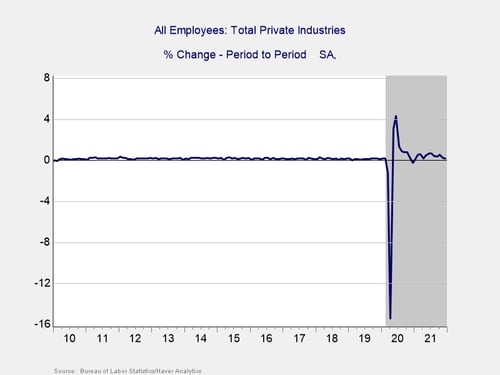

December’s employment report was disappointing at first glance, as 199,000 jobs were added against forecasts for 450,000 additional jobs. With that being said, the October and November reports were revised up by a combined 141,000 jobs, which blunts some of the initial disappointment with December’s headline job growth.

The underlying data was also stronger than the headline number suggests. The household survey showed a much larger increase in employment, resulting in the unemployment rate falling from 4.2 percent in November to 3.9 percent in December against calls for a more modest decline to 4.1 percent. This represents an impressive one-year improvement for the unemployment rate, which was 6.7 percent in December 2020.

Despite the more solid underlying data, given the continued slowdown in headline job growth during the month, we have left this indicator at a yellow light for now.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

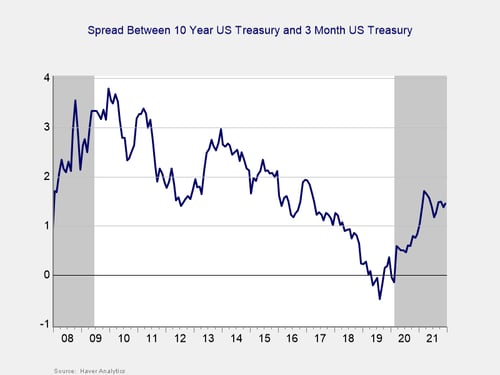

The yield curve steepened moderately in December. This result was due to rising long-term interest rates, as the 10-year Treasury yield increased from 1.43 percent at the end of November to 1.52 percent at the end of December. The three-month Treasury yield increased from 0.05 percent at the end of November to 0.06 percent at the end of December. The current spread of 1.46 percent is in line with the levels that we saw in September and October.

The increase in long-term Treasury yields during the month was largely due to rising expectations for tighter monetary policy from the Fed. Economists largely expect to see the Fed work to combat inflation in 2022, which could lead to more frequent rate hikes as the central bank tries to normalize monetary policy. While tighter monetary policy could lead to some market volatility, it is also an encouraging signal that the Fed views the economy as healthy enough to weather a faster return to normal.

Given the fact that the spread between the 3-month and 10-year Treasury rates remains near the September and October levels, we have left this signal at a green light for now.

Consumer Confidence: Annual Change

Signal: Green light

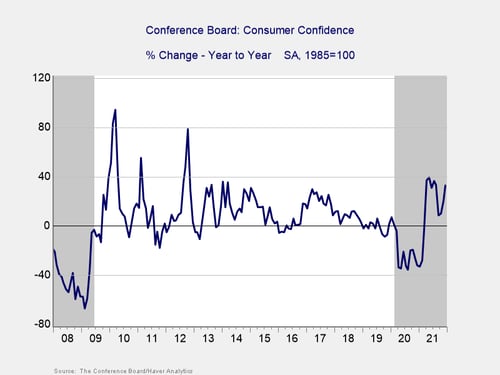

Consumer confidence improved for the third straight month in December, following an upward revision to November’s result. The Conference Board Consumer Confidence Index increased from an upwardly revised 111.9 in November to 115.8 in December. This is a noted improvement from the 2021 low of 87.1 percent we saw in January of last year, when the third wave of infections weighed heavily on sentiment.

On a year-over-year basis, confidence increased by 32.9 percent in December, which is up from the 20.4 percent increase we saw in October.

Historically, declines in confidence of 20 percent or more over the past year are a signal of a recession; the fact that the growth rate increased notably in December was encouraging because it kept the year-over-year figure well outside the historical danger zone.

Since confidence remains well above the 2021 low and outside the danger zone on a year-over-year basis, we have left this indicator at a green light for now.

Conclusion: Economy Poised for Further Growth in New Year

The economic data releases for December largely showed continued economic growth despite concerns about the rise in medical risks and a modestly disappointing employment report. Looking forward, continued growth remains the most likely path forward; however, as we’ve seen throughout the course of the pandemic, there are real risks that remain to this outlook.

The continued hiring growth and solid consumer and service sector confidence during the month are good news but will need monitoring in the months ahead. Ultimately, the pace and path of the expected recovery in the short term remain uncertain. Therefore, caution is still warranted.

We have left the overall economic risk indicator at a yellow light to reflect continued uncertainty and the potential for setbacks in the months ahead.

Print

Print