My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

My colleague Sam Millette, manager, fixed income on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

The economy showed continued growth to start the new year, with the momentum from 2021 carrying over into 2022 despite shifting medical risks in January. The January employment report showed a notable acceleration in hiring, which was an encouraging signal that the economic recovery remains resilient. While business and consumer confidence declined in January, this was understandable given the continued case growth throughout much of the month. There is reason to believe that improvements on the medical front could support improved confidence in the months ahead.

On the medical side, risks declined by the end of January. Daily new case growth peaked mid-month, and we saw case growth decline notably by month-end. High levels of vaccination and natural immunity from previous exposures helped contain the spread of the recent Omicron variant, and the worst medical risk from the recent wave appears to be behind us. While the medical risks are real and certainly worth monitoring, at this time, the impact on the economy remains muted compared to earlier waves.

Given the declines in confidence to start the year, we have left the overall risk level at a yellow for now. With that being said, the impressive job growth in January is a reminder that the economic recovery and growth are expected to continue.

The Service Sector

Signal: Yellow light

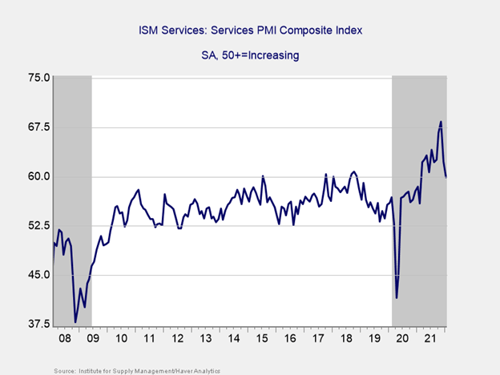

Service sector confidence declined significantly, but by less than expected in January. The ISM Services index fell from 62.3 in December to 59.9 in January against calls for a further drop to 59.5. Despite the decline, this result represents a healthy level of growth for the service sector, as this is a diffusion index where values above 50 indicate expansion.

As you can see in the chart above, service sector confidence remains well above the lows from initial lockdowns and near pre-pandemic highs. Service sector confidence was supported throughout 2021 by public health improvements and the associated easing of state and local restrictions that reassured business owners of the health of the economy. Historically, high levels of business confidence have supported more business spending and output, so this continued result should support continued business investment during the month.

While confidence remains in expansionary territory, the recent declines in the face of the Omicron variant are a potential cause for concern, especially if we see another drop in confidence in February. Given the recent declines, we have downgraded this indicator to yellow for now.

Private Employment: Annual Change

Signal: Green light

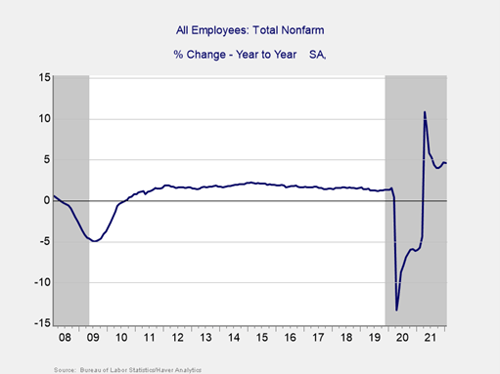

January’s employment report showed that 467,000 jobs were added during the month against calls for a more modest 125,000 jobs. Additionally, the November and December job reports were revised up by a combined 709,000 jobs. The better-than-expected January result, and the positive revisions to past reports, indicate that the labor market recovery continued at a healthy pace at the end of 2021 and the start of 2022 despite the headwinds created by the Omicron variant.

The underlying data was also encouraging. While the unemployment rate increased from 3.9 percent in December to 4 percent in January, this was largely due to an increase in the labor force participation rate, which is a positive sign that folks are rejoining the job market.

Given the better-than-expected result in January and positive revisions to the previous job reports, we have upgraded this signal to a green light for now.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

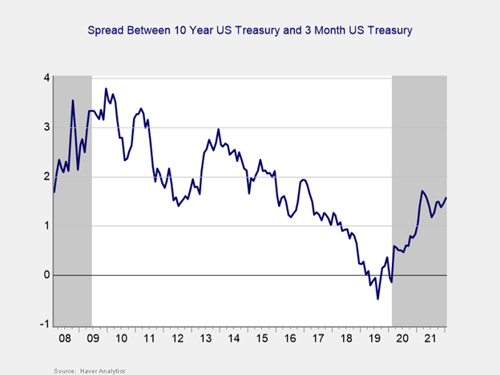

The yield curve steepened slightly in January. This result was caused by rising long-term interest rates, as the 10-year Treasury yield increased from 1.52 percent at the end of December to 1.79 percent at the end of January. This increase for long-term yields was more than enough to offset an increase in short-term rates during the month. The three-month Treasury yield increased from 0.06 percent at the end of December to 0.22 percent at the end of January. The rise in both short- and long-term yields was primarily due to rising expectations for a rate hike at the Fed’s next meeting in March.

Economists expect to see the Fed focused on combatting inflation in 2022, which could lead to more frequent rate hikes as the central bank tries to normalize monetary policy. While tighter monetary policy could lead to some market volatility, it is an encouraging signal that the Fed views the economy as healthy enough to endure a faster return to normal.

Given the fact that the spread between the 3-month and 10-year Treasury rates remains near September and October levels, we have left this signal at a green light for now.

Consumer Confidence: Annual Change

Signal: Green light

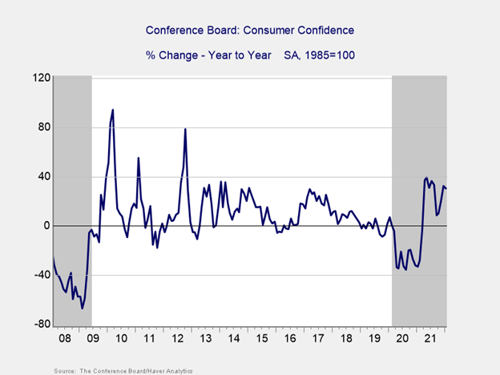

Consumer confidence declined in January, following a downward revision to December’s result. The Conference Board Consumer Confidence Index fell from 115.2 in December to 113.8 in January. While the decline to start the new year was slightly disappointing, this is a noted improvement from the 2021 low of 87.1 percent we saw in January of last year, when the third wave of infections weighed heavily on sentiment.

On a year-over-year basis, confidence increased by 30.65 percent in January, which is down slightly from the 32.26 percent increase we saw in December.

Historically, declines in confidence of 20 percent or more over the past year are a signal of a recession; the fact that the growth rate remained high in January was encouraging because it kept the year-over-year figure well outside the historical danger zone.

Since confidence remains well above the 2021 low and outside the danger zone on a year-over-year basis, we have left this indicator at a green light for now, although further declines in the months ahead could lead to a downgrade.

Conclusion: Economy Set for Further Growth

The economic data releases for January largely showed continued economic growth despite concerns about the Omicron variant. Looking forward, continued growth remains the most likely path forward; however, as we’ve seen throughout the course of the pandemic, there are real risks that remain in this outlook.

The accelerated hiring growth during the month was good news but will need monitoring in the months ahead, as will consumer and business confidence. Ultimately, the pace and path of the expected recovery in the short term remain uncertain. Therefore, caution is still warranted.

We have left the overall economic risk indicator at a yellow light to reflect continued uncertainty and the potential for setbacks in the months ahead. As the outlook continues to improve, an upgrade to green is likely in the coming months.

Print

Print