My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

My colleague Sam Millette, senior investment research analyst on Commonwealth’s Investment Management and Research team, has helped me put together this month’s Economic Risk Factor Update. Thanks for the assist, Sam!

The economic recovery continued in July, as the momentum from recent reopening efforts drove growth despite rising medical risks. The July employment report showed that the pace of hiring continued to accelerate during the month, with headline job growth coming in above economist estimates and hitting the highest level in a month since last August. Consumer and business confidence also came in well above expectations.

Despite the very real progress during the month, not all the news was good. On the medical side, case growth increased notably as the Delta variant led to a surge in new infections. On the economic side, supply chain issues remain an unresolved question, and overall employment is still below pre-pandemic levels. Overall, we’ve kept the economic risk level at yellow for now, but we’ll be keeping a close eye on the rising medical risks and any potential effect they may have on the economy. Although we have made progress in terms of containing the pandemic and bringing the economy back, we are not there yet, and the uncertain path to normal indicates that economic risks remain.

The Service Sector

Signal: Green light

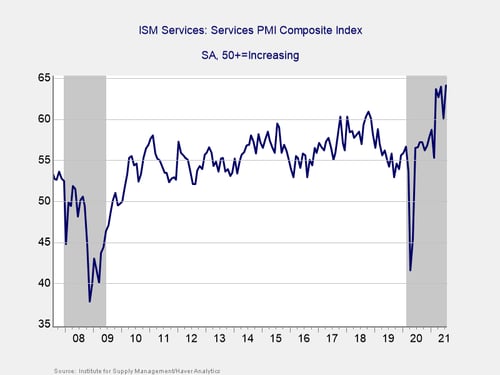

Service sector confidence increased by more than expected during the month, rising from 60.1 in June to 64.1 in July against calls for a more modest increase to 60.5. This rebound following June’s pullback was an encouraging result that left the index at its highest level on record. This is a diffusion index, where values above 50 indicate expansion, so the report showed that service sector growth accelerated.

Service sector confidence has rebounded well since suffering from a largely weather-driven decline in February, and the index has now remained above pre-pandemic levels for the past five straight months. Service sector confidence has been supported throughout the year by public health improvements and the associated easing of state and local restrictions that have given business owners more confidence in the ongoing economic recovery. High levels of service sector confidence are a good sign for business investment and hiring, as improved confidence has historically supported faster spending growth. The record high service sector confidence in July despite the worsening public health situation is a sign that business confidence appears to be more resilient now than earlier in the pandemic.

Given the rebound in confidence in July and the record high level for the index, we have left this signal as a green light.

Private Employment: Annual Change

Signal: Yellow light

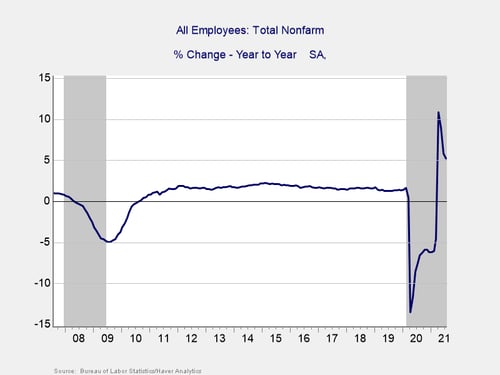

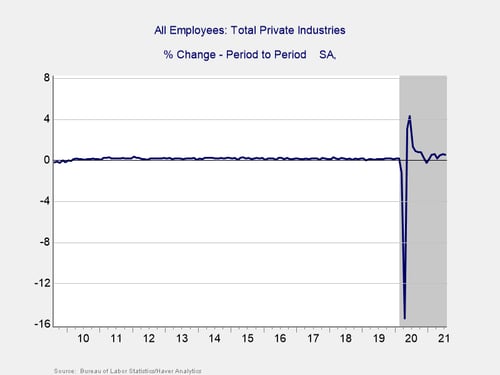

July’s employment report showed that the economy added 943,000 jobs during the month, which was an increase from the upwardly revised 938,000 jobs added in June and above economist estimates for 870,000 additional jobs. This result now marks seven straight months with job growth following a temporary lull in hiring last December. This also represents the best month for hiring since last August.

Although July saw year-over-year employment increase by 5.2 percent, this was primarily due to the large decline in jobs we saw last spring and summer due to the initial lockdowns. The total number of jobs across the economy remains down by more than 5.7 million compared with pre-pandemic peak levels.

While the accelerating job growth in July was encouraging, the increasing health risks throughout the month indicate that we may see the pace of hiring slow in the months ahead. Given the still large decline in overall employment compared with the pre-pandemic peak, we have left this indicator at a yellow light for now, with an upgrade to green possible in the months ahead if we continue to see accelerated job growth, despite the rising medical risks.

Yield Curve (10-Year Minus 3-Month Treasury Rates)

Signal: Green light

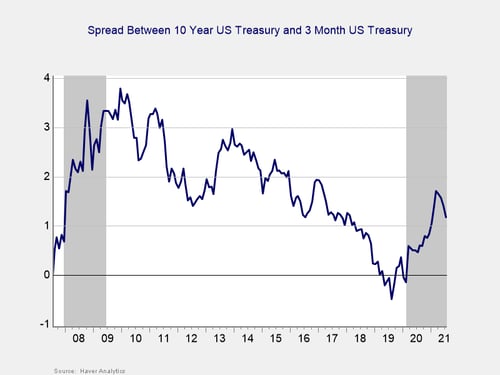

The yield curve flattened for the fourth month in a row. This result was primarily driven by a decline in long-term interest rates. The 10-year Treasury yield fell from 1.45 percent at the end of June to 1.24 percent at the end of July. The decline in long-term yields was largely driven by investor concerns about the rising risk from the Delta variant of the virus.

The three-month Treasury yield increased modestly from 0.05 percent at the end of June to 0.06 percent at the end of July. While short-term rates are expected to remain low until at least 2023, longer-term rates had previously recovered back to pre-pandemic levels before the recent decline. Although long-term rates remain well above the pandemic-induced lows we saw throughout much of last year, the recent decline is worth monitoring, as it could signal increased investor concern about the pace of the economic recovery due to the Delta variant.

Given the fact that long-term yields remain above the 2020 lows, we have kept this signal at a green light for now. With that being said, if long-term rates continue to decline, we may see further yield curve flattening and a potential downgrade to yellow.

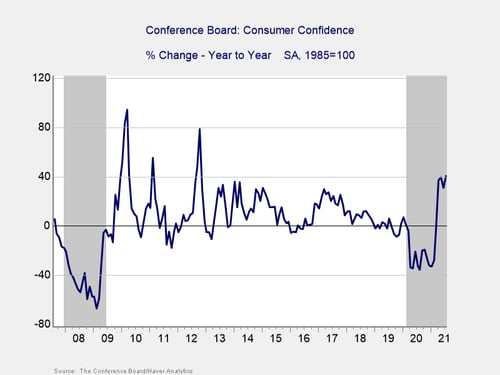

Consumer Confidence: Annual Change

Signal: Green light

Consumer confidence increased by more than expected in July. The Conference Board Consumer Confidence Index rose from an upwardly revised 128.9 in June to 129.1 in July against calls for a decline to 123.9. This result brought the index to its highest level since the start of the pandemic and signals that consumer sentiment continued to improve during the month. Consumer confidence has been supported by improvements in public health throughout the year, additional rounds of federal stimulus payments, and accelerating job growth. Given the increasing medical risks in July, this was an especially impressive report as it signaled that consumers largely shrugged off the increased risks.

While the 40.8 percent year-over-year increase in confidence was largely due to a sharp drop in confidence last spring and summer, the recent improvements for the index have brought confidence back to pre-pandemic levels. Historically, declines in confidence of 20 percent or more over the past year are a signal of a recession, so the improvement in the year-over-year data throughout the course of the year has been very encouraging, as it has brought the year-over-year figure out of the historical danger zone.

Given that confidence has now returned to pre-pandemic levels and remains strong on a year-over-year basis, we have left this indicator at a green light.

Conclusion: Continued Growth in July Despite Rising Risks

The economic data releases from July largely pointed toward accelerated growth, despite the rising medical risks. The improvements for consumer and service sector confidence and job growth were encouraging signs that the economic recovery continued to pick up steam in July, driven by the momentum from the recent nationwide reopening efforts.

While continued growth remains the most likely path forward, this past month shows that it is still too early to say we are back to normal. The high levels of business and consumer confidence should continue to support additional spending growth; however, risks remain, which could cause uncertainty over the path and pace of the expected recovery and negatively affect confidence in the months ahead. We’ve seen uncertainty increase recently, as growing investor concerns about the potential impact of the Delta variant shows.

Given this uncertainty and the continued stress on the labor market, risks to the economic recovery remain, even if continued growth is the most likely path forward. The continued recovery in July was encouraging, and we have left three of the four indicators at a green light for now, with a future upgrade to the labor market possible if we continue to see accelerated job growth. We have left the overall economic risk indicator at a yellow light to reflect the rising uncertainty created by the Delta variant and the potential for setbacks in the months ahead.

Print

Print