A couple of weeks ago, we left off our discussion on the labor market with the conclusion that the labor market shifts were real and reflected underlying changes in both the demographics and demand for jobs. Knowing that, however, doesn’t tell us what is likely to happen in the future. So, let’s think through the factors that will determine just that.

A couple of weeks ago, we left off our discussion on the labor market with the conclusion that the labor market shifts were real and reflected underlying changes in both the demographics and demand for jobs. Knowing that, however, doesn’t tell us what is likely to happen in the future. So, let’s think through the factors that will determine just that.

No Excess Workers?

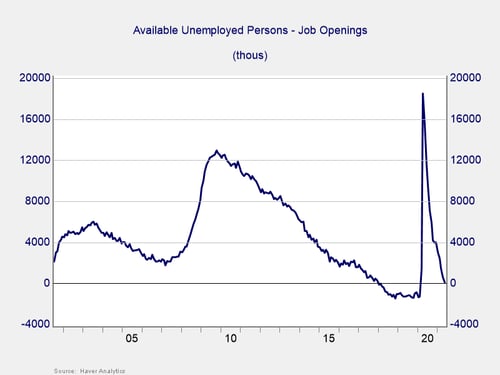

Starting with the short term, there are now essentially no excess workers (i.e., workers available beyond those needed to fill the current existing openings). Obviously, this is a problem. But it is less of a problem than it appears because of the way available workers are defined. In the stats, available workers means people who are actively looking for work. If you are not actively looking, for whatever reason, you are categorized as not in the labor force. So, no available workers essentially means no workers who are actively looking at the present time.

People change their minds, however. Someone who is not actively looking—and thus not in the labor force—at $9 per hour may well decide to look at $15 per hour. If those people decide to actually get a job, then the available pool of workers goes up. So, the relevant number here is how many people who are currently out of the labor force—and thus not showing up as available—might start looking for a job.

To determine whether the job market is likely to normalize in the short term, we need to know how many of these people are both available and likely to start actively looking for a job, given recent increases in wages. If there are enough to return the labor market to something like normal, then we will see it normalize.

How Many Workers Do We Need?

The number of available workers obviously includes at least the number of jobs for a healthy labor market. But we have that now, and the labor market is not healthy. Therefore, we also need to consider that in a healthy job market, a number of people will be unemployed at any given time. This allows for job changes, life changes, and not least for future growth in the job market. Those people, who can make the labor market flexible and responsive again, are what we need for the labor market to normalize.

The good times. One way to estimate that target number is to look at history. The chart below shows us that in good times when the labor market was healthy, say 2006 or the 2015–2016 period, that number is between 2 and 3 million. So let’s assume we need about 2.5 million more people looking for work than current openings.

Right now, we have a balance, with available workers equaling job openings. We need to find 2.5 million workers, not in the labor force, who are willing to work if we hope to normalize the labor market. Fortunately, we have a data series that tracks that and looks at people who are not in the labor force but who want a job now. This series can capture the available labor force that is not in the available worker pool.

Who wants a job? While the data series is useful, however, the sheer number of available people doesn’t necessarily answer our question, as not all of them will actually take a job. For that, we need to adjust for the normal number of people who say they want a job. The excess of people who want a job now over that normal level are most likely to act in the short term and are the best candidates to move back into the labor force.

That baseline number of people who are not in the labor force but want a job now is about 4.5 million, taken from the chart above for the 2000s and from the most recent pre-pandemic data. The numbers are higher in the aftermath of the financial crisis, as you would expect, but seem to converge around that figure as the economy normalized. With the current number of people available at around 6.5 million, there are therefore about 2 million workers above that baseline number who are likely to move back into the workforce in the short term.

This number is quite close to what we estimated as the number needed to normalize the job market. As all of these numbers are estimates, and as wage increases are likely to continue for some time, it seems reasonable to conclude that the actual number of workers who will move back into the labor force will be somewhat higher. That will indeed normalize the job market in the reasonably short term, albeit at a higher wage level. The workers are there, they just need to be drawn back—and that is happening. The numbers show us that this is a real problem, but that it can be solved and is, in fact, on the way to being solved.

The Long View

Here in the U.S., then, labor markets are likely to normalize over the next couple of quarters as people (available people, who want jobs) move back into the labor force. That’s the good news. Longer term, however, the picture is a bit different. We will talk about that next.

Print

Print