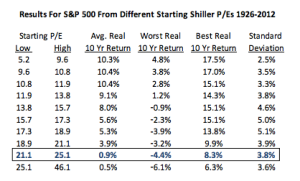

A couple of bad days recently have rattled many investors. After the strong run-up in the stock market to the end of last year and the continued strong economic reports, many expected the market would continue to perform strongly. Instead, we have had stability for most of the month, with small declines followed by recoveries—until the past week, when we’ve seen one of the worst sell-offs in the past couple of years. What gives?

The key phrase there is “the past couple of years.” So far, we have seen, at worst, about a 4-percent decline, and as of this morning, the market has ticked back up. Is this something we should be worried about?