Yesterday, I talked about housing demand and concluded that it is not only healthy but likely to increase. This represents only one-half of the picture, however. In many ways, the more important half is what that demand means for the housing supply. Home building requires labor, materials, financing, and most other sectors of the economy, so it can provide even more of a boost to the economy as a whole.

Yesterday, I talked about housing demand and concluded that it is not only healthy but likely to increase. This represents only one-half of the picture, however. In many ways, the more important half is what that demand means for the housing supply. Home building requires labor, materials, financing, and most other sectors of the economy, so it can provide even more of a boost to the economy as a whole.

Let’s start with the big picture.

Housing supply: The big picture

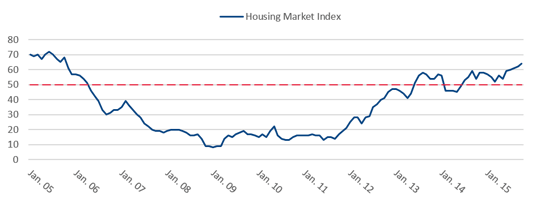

Industry sentiment. The National Association of Home Builders, from whose website the following graph—which shows the sentiment of companies within the industry—is taken, tracks its constituents closely.

You can see that we have moved back to the highest level since before the bubble burst. Clearly, the industry itself feels confident about the future.

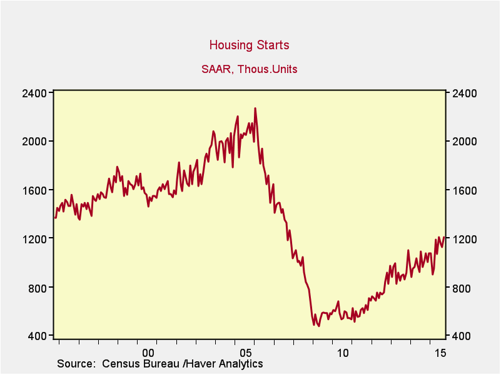

Housing starts. Based on past levels of construction, this confidence looks justified. From the next chart, you can see that there has been substantial growth in housing starts over the past several years. And the potential for substantial additional growth remains, possibly even bringing us closer to the lowest levels since before the crisis.

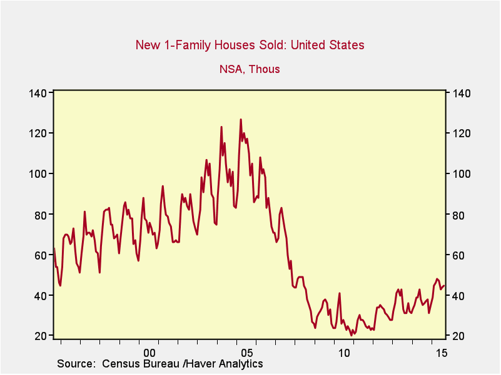

Sales of single-family homes. Looking at a smaller data set, for single family homes, and focusing on sales rather than starts, we see the same trend: increases over the past several years but still a ways to go before catching up with historical levels.

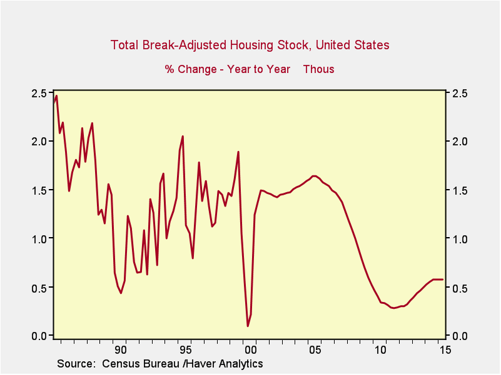

Housing stock. Stepping back for a final big-picture look, the total housing stock of the U.S. has grown over the past 10 years. Again, however, there remains considerable room for improvement, since that growth rate has been well below typical levels—and, more important, below the level of population and household growth.

Clearly, there is room for housing to continue to grow, but the housing industry can’t be considered in isolation. We also have to analyze how it will affect the larger economy. And the most direct way to look at this is via employment.

Housing and the economy

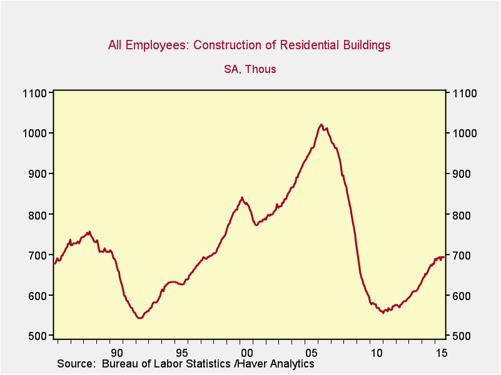

Residential construction jobs. Residential construction has added about 150,000 jobs since the post-crisis bottom. As the industry continues to improve, however, we can see that there will be room for another 100,000 jobs or so just to get back to the level of 2000, without even considering additional growth. So, housing will continue to generate jobs.

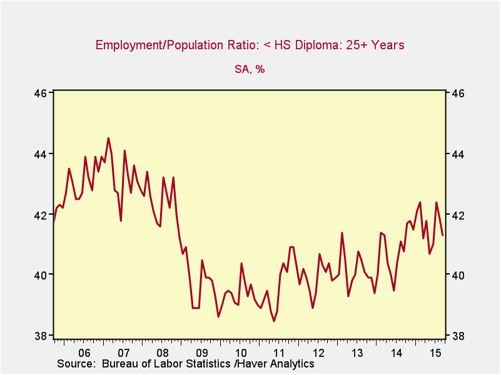

Employment-to-population ratio. Another factor worth considering is that historically construction has offered opportunities to less educated cohorts of the population. Here we can see that, with the recovery of the construction industry, the employment-to-population ratio has risen—and again has potential to rise even more. This has been one of the worst-hit employment cohorts, and improvement here is particularly welcome.

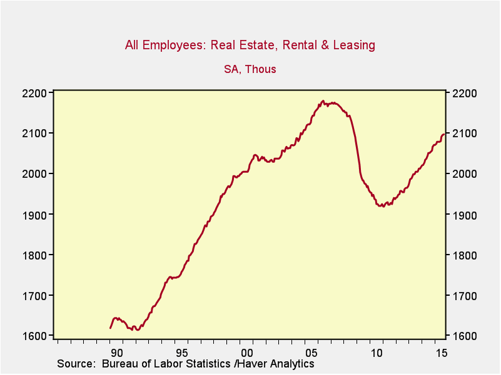

Real estate jobs. Beyond direct construction jobs, we can see the same kind of employment trends when we look at real estate jobs. This sector has added about 200,000 jobs, and while it is getting close to previous peaks, there is still additional room for growth.

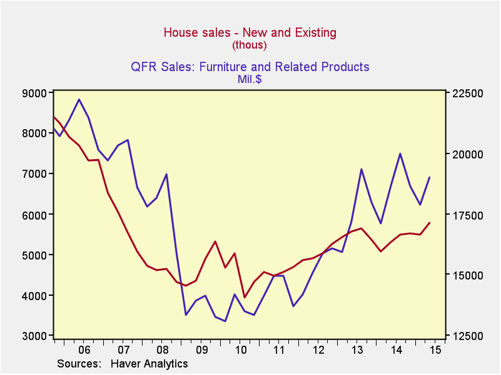

Furniture sales. The previous discussion only considers the direct impact to employment. There are indirect impacts as well, including furniture sales.

This chart shows the correlation between house sales and furniture sales. When you buy a house, you need new furniture, right? This sector is emblematic of the multiple other purchases housing drives, including paint, lawnmowers, linens, and more.

The takeaways

We can take away two things from this data:

- The housing industry has improved measurably, to the benefit of the economy as a whole.

- There is room for this improvement both to continue and to accelerate, which will echo throughout the entire economy.

We saw yesterday that housing demand exists and today that supply is rising and will continue to do so to meet that demand. We also saw the many ways housing can power many other sectors of the economy. When you combine the consumer confidence required to buy a house with the effective demand created by the growth of households and employment, and then factor in the many ways this sector stimulates the economy, I would argue that this provides a large part of the foundation the economy needs to continue moving forward.

This is just one of the reasons why I continue to say that, although the recovery is slowing at the moment, the story is not over yet.

Print

Print