Brad here. As part of my Next World series on this blog, I have been discussing the themes and implications with Commonwealth analysts to try to determine what it will mean, over time, for how we invest. Anu Gaggar, our international analyst, put together this piece, which I think is worth sharing. Take it away, Anu!

Brad here. As part of my Next World series on this blog, I have been discussing the themes and implications with Commonwealth analysts to try to determine what it will mean, over time, for how we invest. Anu Gaggar, our international analyst, put together this piece, which I think is worth sharing. Take it away, Anu!

Brad touched upon emerging markets and their dependence on world trade in his Next World series, but he didn’t arrive at specific conclusions. Let’s dig deeper to see how that dependence affects emerging market investors. This will give us direction as we enter a next world that might be less integrated than its predecessor.

More global trade has meant stronger GDP

Global trade has lifted the fortunes of many emerging markets. In 2017, developing economies accounted for 44 percent of world merchandise exports and 34 percent of world trade in commercial services. Empirical data from the last half century suggests a correlation between economic growth and trade. In other words, higher global economic integration has led to stronger GDP for emerging markets.

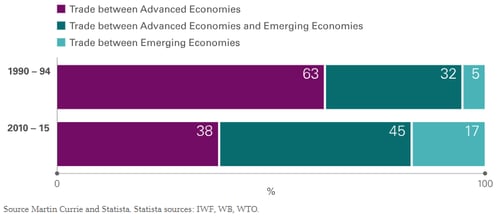

As emerging markets have grabbed a greater share of trade, the overall role of developed nations in world trade has diminished. Combined with the current wave of decline in free trade, as well as the rise in nationalism across many developed nations, this has added fuel to the fire of trade protectionism.

With the increasing dependence of emerging markets on global trade, it is only natural that these nations will feel the pain when developed nations erect trade barriers and trade volumes and values go south. One way to analyze the impact and set future expectations is to look at historical changes in the values of emerging market assets as their exports changed.

MSCI Emerging Markets Index versus emerging market exports

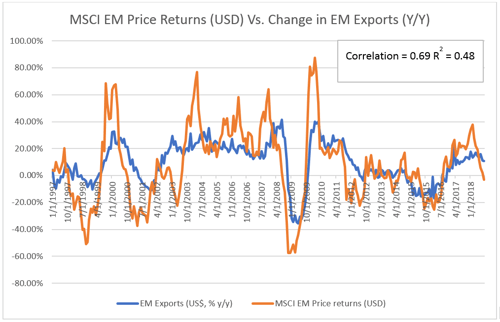

For our analysis, we stick to emerging market equities and compare changes in the MSCI Emerging Markets Index in U.S. dollar terms with changes in emerging market exports. Using U.S. dollar price returns is meaningful here because it accounts for returns after currency effects. We also use price returns instead of total returns because dividend policies tend to be sticky and don’t necessarily react immediately to changes in the macro environment.

The chart below plots the relationship over the past 30 years. We note a strong correlation of 0.69 between year-over-year changes in emerging market exports and MSCI Emerging Markets Index price returns. The index not only rises and falls with changes in emerging market exports, but it also exceeds changes in exports in both directions.

Source: MSCI, World Bank

Why? Companies in emerging economies derive a greater share of their revenues from selling their goods and services outside their home countries. Trade barriers make their products more expensive for foreign buyers and result in demand switching or substitution. This reduces revenues and earnings expectations for the emerging market companies and affects the value of their equities. Both the direction and magnitude of the changes make intuitive, theoretical, and empirical sense.

A growing protectionist environment is therefore negative for the near-term outlook of emerging market equities in the aggregate. But the emerging markets investing story is more nuanced than that.

More than just a single investment basket

Most developed countries are considered for their individual merits. Emerging markets, however, are generally treated as one investment basket instead of 24 disparate countries that don’t necessarily correlate to one another. Each nation’s market differs more than investors realize, and that trend is increasing.

Many emerging nations have developed their local markets multifold. They are trading more among themselves than they have in the past, as the below chart illustrates.

In addition, in terms of trade and export specialization, there is significant heterogeneity across developing countries. For example, despite openness to trade and ongoing liberalization efforts, several developing nations, notably in Africa, have not succeeded in diversifying their production and exports. On the other hand, for emerging economies in Asia and Latin America, higher trade has been associated with higher export diversification. Clearly, when faced with trade barriers, some emerging economies are more resilient than others.

What this means for investors

Where does this lead us regarding current positioning in emerging market equities? There are no winners in trade wars, but emerging markets are less resilient to trade jitters. When the going gets tough in emerging markets, the baby gets thrown out with the bath water, and all the emerging market countries trade as a single basket. This, however, makes valuation more attractive for the more diversified and resilient countries and companies in the emerging market basket. And these countries and companies tend to offer better alpha opportunities for active long-term investors.

Brad here again. The data is clear. The next world will indeed be different from the present world, and investors need to take care. But there will also be opportunities. I suspect that the emerging markets to focus on will be those with growing labor forces and consumer markets, such as India and Africa, and not necessarily the current standouts. Emerging markets will remain a growth area, but selection will be key. One more reason to pay attention and not take past performance for granted!

Print

Print