The next phase in the Ukraine crisis has begun, as Russia has launched attacks on Ukraine. With a war underway, it’s unsurprising that the markets are reacting. Before the market opened, U.S. stock futures were down between 2 1/2 percent and 3 1/2 percent, while gold was up by roughly the same amount. The yield on 10-Year U.S. Treasury securities has dropped sharply. International markets were down even more than the U.S. markets, as investors fled to the more comfortable haven of U.S. securities.

The next phase in the Ukraine crisis has begun, as Russia has launched attacks on Ukraine. With a war underway, it’s unsurprising that the markets are reacting. Before the market opened, U.S. stock futures were down between 2 1/2 percent and 3 1/2 percent, while gold was up by roughly the same amount. The yield on 10-Year U.S. Treasury securities has dropped sharply. International markets were down even more than the U.S. markets, as investors fled to the more comfortable haven of U.S. securities.

Markets Hit Hard

News of the invasion is hitting the markets hard right now, but the real question is whether that hit will last. It probably will not. History shows the effects are likely to be limited over time. Looking back, this event is not the only time we have seen military action in recent years. And it’s not the only time we’ve seen aggression from Russia. In none of these cases were the effects long-lasting.

Context for Today's Events

Let’s look back at the Russian invasion of Georgia, and the Russian takeover of Crimea, which is part of Ukraine. In August 2008, Russia invaded the republic of Georgia. The U.S. markets dropped by about 5 percent, then rebounded to end the month even. In February and March 2014, Russia invaded and annexed Crimea. The U.S. markets dropped about 6 percent on the invasion, but then rallied to end March higher. In both cases, an initial drop was erased quickly.

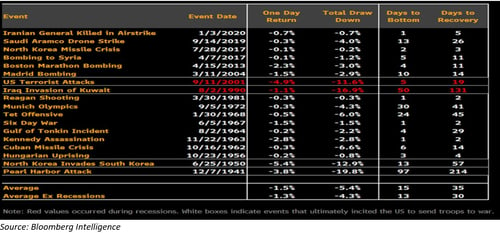

When we look at a wider range of events, we largely see the same pattern. The chart below shows market reactions to other acts of war, both with and without U.S. involvement. Historically, the data shows a short-term pullback—as we will likely see today—followed by a bottom within the next couple of weeks. Exceptions include the 9/11 terrorist attacks, the Iraqi invasion of Kuwait, and, looking further back, the Korean War and Pearl Harbor attack.

Still, even with these exceptions, the market reaction was limited both on the day of the event and during the overall time to recovery. In fact, comparing the data provides useful context for today’s events. As tragic as the invasion of Ukraine is, its overall effect will likely be much closer to that of the Russian invasion of Ukraine in 2014, when Russia annexed Crimea, than it will be to the aftermath of 9/11.

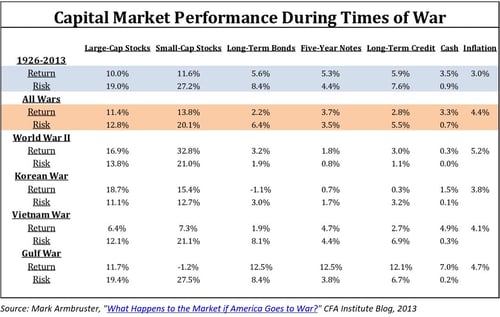

Capital Market Returns During Wartime

But even with the short-term effects discounted, should we fear that somehow the war or its effects will derail the economy and markets? Here, too, the historical evidence is encouraging, as demonstrated by the chart below. Returns during wartime have historically been better than all returns, not worse. Note that the war in Afghanistan is not included in the chart, but it too matches the pattern. During the first six months of that war, the Dow gained 13 percent and the S&P 500 gained 5.6 percent.

Headwind Going Forward

This data is not presented to say that today’s attack won’t bring real effects and hardship. Oil prices are up to levels not seen since 2014, which was the last time Russia invaded Ukraine. Higher oil and energy prices will hurt economic growth and drive inflation around the world and especially in Europe, as well as here in the U.S. This environment will be a headwind going forward.

Economic Momentum

To consider additional context, during the recent waves of Covid-19, the U.S. economy demonstrated substantial momentum. Looking ahead, this momentum should be enough to move us through the current headwind until the markets normalize once more. In the case of the energy markets, we are already seeing U.S. production increase, which should help bring prices back down—as has happened before. Will we see effects from the headwind caused by the Ukraine invasion? Very likely. Will they derail the economy? Not likely at all.

Historically, the U.S. has survived and even thrived during wars, continuing to grow despite the challenges and problems. That is what will happen in the aftermath of today’s attack by Russia. Despite the very real concerns and risks the Ukraine invasion has created and the current market turbulence, we should look to what history tells us. Past conflicts have not derailed either the economy or the markets over time—and this one will not either.

Consider Your Comfort Level

So, should we do anything with our portfolios? Personally, I am not taking action. I am comfortable with the risks I am taking, and I believe that my portfolio will be fine in the longer term. I will not be making any changes—except perhaps to start looking for some stock bargains. If I were worried, though, I would take time to consider whether my portfolio allocations were at a comfortable risk level for me. If they were not, I would talk to my advisor about how to better align my portfolio’s risks with my comfort level.

Ultimately, although the current events have unique elements, they are really more of what we have seen in the past. Events like today’s invasion do come along regularly. Part of successful investing—sometimes the most difficult part—is not overreacting.

Remain calm and carry on.

Print

Print