Back in the office after my vacation, the news is generally good. Economic stats continue to surprise to the upside, markets are close to all-time highs, and the Labor Day weekend is coming. So, of course, as Eeyore, my thoughts are turning to things to worry about.

Back in the office after my vacation, the news is generally good. Economic stats continue to surprise to the upside, markets are close to all-time highs, and the Labor Day weekend is coming. So, of course, as Eeyore, my thoughts are turning to things to worry about.

I’m not the only one either. A reader recently wrote in asking, “What about the national debt?” He felt that the problem surely had not gone away and was wondering what investors should do about it.

Deficit vs. debt

First, let’s distinguish between the federal deficit (when the government spends more than it takes in from taxes) and the debt (the accumulated balance from past deficits).

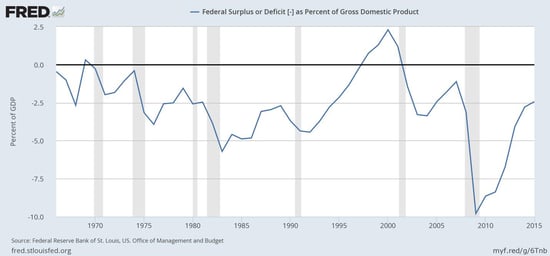

We have made good progress on the deficit. As you can see in the chart below, the deficit—at approximately 2.4 percent of GDP—is about where it has been for much of the past 50 years.

With the economy growing, a small deficit is sustainable over time. Right now, the deficit exceeds the growth level, so debt is getting worse, but slowly. From a big-picture perspective, we are only digging the hole deeper at a very slow rate.

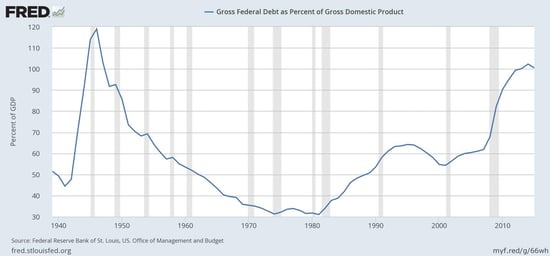

The problem is that the hole is already pretty deep. Looking at the debt as a proportion of the total economy, which is the best way to do it, we can see that it’s at the highest levels since just after World War II.

We owe a heck of a lot of money.

But, although the comparison to the post-World War II period is scary, there’s also a positive spin on this: we solved the problem then. Other countries, including Canada and Sweden, have had similar or worse issues in the recent past and normalized their debt levels. And many countries actually have higher debt levels than we do and continue to operate.

Though this is a problem, it is a solvable one.

Potential resolutions for the debt problem

There are lots of ways in which the U.S. debt problem could be solved. Among the possibilities:

- The Fed forgives the debt it holds. (Poof! There goes a couple of trillion!) That’s unlikely but certainly possible.

- Very likely and very possible, inflation slowly erodes the real value of the debt.

- Also very probable, growth picks up again (likely when the millennials really get going in 5 to 10 years) and we grow our way out of trouble, as we did in the 1950s and 1990s.

It’s even possible Congress might get its act together and work responsibly to help the process along. If this happens, then investors won’t need to do anything to deal with the debt problem.

On the other hand, Congress could continue to screw up, in which case we will need to worry about our investments and take action to protect ourselves. But there will be ample opportunities to observe and adjust ahead of time. If this is a crisis at all, it’s a very slow-moving one, and we will have time to step out from in front of the steamroller.

As investors, when we consider the debt problem, the question is not whether we should act; it's when we should act. Right now is not the time, as this is not an immediate or even a medium-term problem.

Let's not get ahead of ourselves

The benefits of any measures we might take now are far from certain, but the costs are real. By acting now, we may end up taking a real loss to protect ourselves from an (at this point) imaginary risk. For example, you buy fire insurance to protect your house because fire is a real and quantifiable risk. If you live in a desert, though, you wouldn’t buy flood insurance on the off chance it might rain like hell some day. If it started to get rainier over time, however, you might.

There is a real-world example of this—Japan. Traders have been betting on the collapse of the Japanese economy, due to excessive debt, for decades, to the extent it is now known as the widowmaker trade. Fortunes have been lost betting on an inevitable collapse that hasn’t happened yet.

In the end, as investors, we should be aware of the problem of the debt—and it is a problem—but not get ahead of ourselves. What should we do? Nothing, yet. My own position is watch the weather and reach for an umbrella when it starts to cloud up, but not before.

Print

Print