Over the past couple of days, I’ve said again and again that the U.S. is in good shape economically, and that the problems rattling the markets are coming from elsewhere in the world. Today, let’s take a closer look at where we stand, and why I think we're well positioned to ride out any market turmoil.

Over the past couple of days, I’ve said again and again that the U.S. is in good shape economically, and that the problems rattling the markets are coming from elsewhere in the world. Today, let’s take a closer look at where we stand, and why I think we're well positioned to ride out any market turmoil.

Employment fuels U.S. recovery

For all the talk about how the U.S. jobs recovery is subpar (I disagree), we continue to move from strength to strength. Job growth is strong, initial jobless claims are at their lowest level since 2000, and multiple other measures show the same thing. Unemployment is closing in on normal levels.

Europe not faring so well

Now, let’s compare the situation in the U.S. to that in Europe.

Using this chart, from Eurostat, you can see that U.S. and European unemployment were substantially the same during the crisis. Europe’s unemployment continued to rise, however, and remains above crisis levels, while U.S. unemployment has returned close to normal.

Unemployment is a key reason that Europe is moving back into crisis mode, rocking world financial markets in the process. Here in the U.S., the economy depends on consumer spending—that is, jobs and wage income—and most of Europe is the same. No jobs, no recovery, and no growth.

Beyond economics, the political aspects of unemployment are equally corrosive. I no longer believe the euro will last, and the growing tension between France and Germany, at the core of the eurozone, makes that clearer every day. The euro is no longer a popular tool of prosperity but a symbol of austerity and German oppression. Rising anti-euro and anti-EU parties are winning bigger shares of the vote in every country, including Germany.

China also on shaky ground

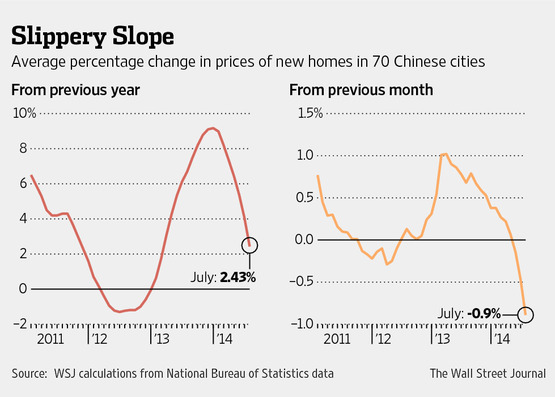

In many ways, China is in no better shape. While growth reportedly continues, real estate values are starting to decline—exactly the sort of trend we saw in the U.S. in 2008.

You will hear arguments that China is different for a variety of reasons, which may well be valid—I don’t know. I do know that real estate has been a major growth engine there, as it was in the U.S. An end to growth in the real estate market should hit growth overall, something China can’t really afford as it tries to transition its economy away from exports and real estate/infrastructure as growth engines.

Overall, we’re doing quite well

In short, almost all of the data indicates that the U.S. economy is recovering, and quite possibly accelerating. For China, and especially Europe, most of the data is much less positive or actively negative. The contrast is stark.

As we’ve seen over the past week, the U.S. will certainly be affected by turmoil elsewhere in the world. Expect more shocks, both to our real economy and to our financial markets. The difference between now and 2008, though, is that we have a more solid economic foundation to ride out the trouble. Our banking system, in particular, is better capitalized and less exposed than it was then.

This isn't to say we won't face troubles; we almost certainly will. But we’re in a much better place than we have been in nearly a decade to weather any market storms.

Print

Print