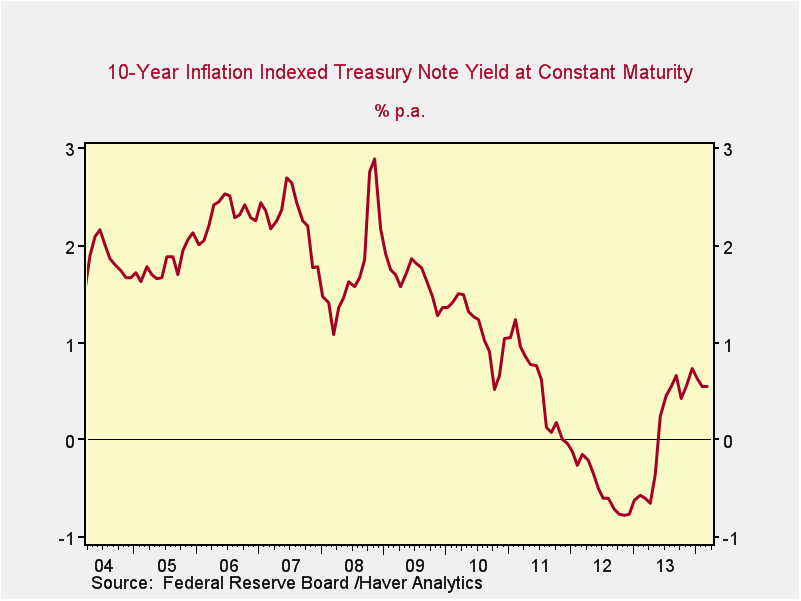

The last time that the Federal Reserve (Fed) was widely expected to start reducing, or “tapering,” its bond purchase program, earlier this fall, interest rates increased and the market tanked. Widely referred to as the “taper tantrum”—a term I wish that I had invented—the drop was quickly reversed when Fed officials came out and reassured the market that, in fact, they had no intentions of pulling back, ever. Really.

That was then. Since that time, the economy has shown improved growth, interest rates have ratcheted back down, and the stock market has recovered and powered up to new highs. With the recent good economic news—much higher levels of GDP growth than expected, higher employment figures and lower unemployment, and very positive business surveys, among other highlights—the Fed is at a point where a taper pretty much has to start soon. Maybe not this week, but soon. The budget deal in Washington also makes a taper more likely because the last reason for the Fed to continue its stimulus was worry about fiscal policy disruption.