I took down a tree over the weekend, using a handsaw, branch cutters, and a ladder. I had to do it piecemeal, one branch at a time, as it was right next to my house. That’s a lot of work, and I was sweating hard by the time I got down to the main trunk and had dragged the rest of the tree to the back yard. Yesterday, when I was cutting down the remains for disposal, the weather was a lot colder. A sweater, a fleece, and gloves weren’t keeping me warm. It was a big shift from one day to the next—but hey, I live in New England.

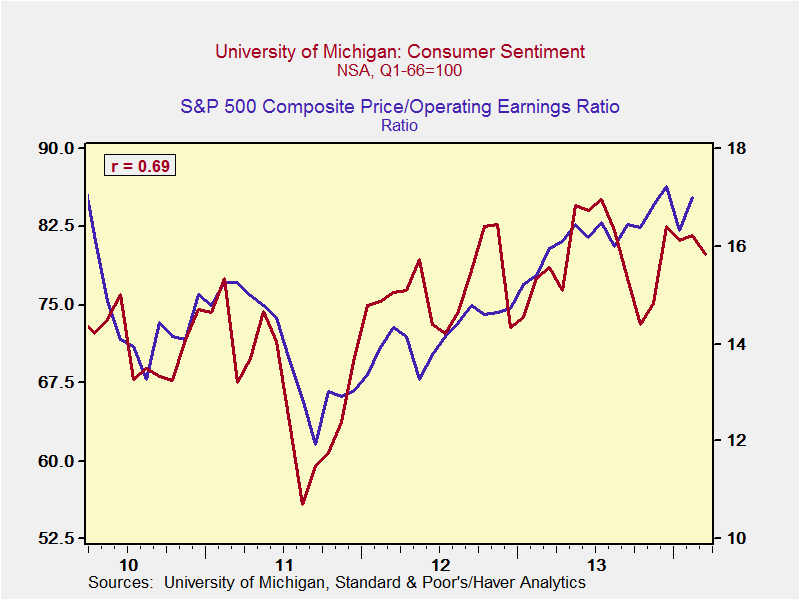

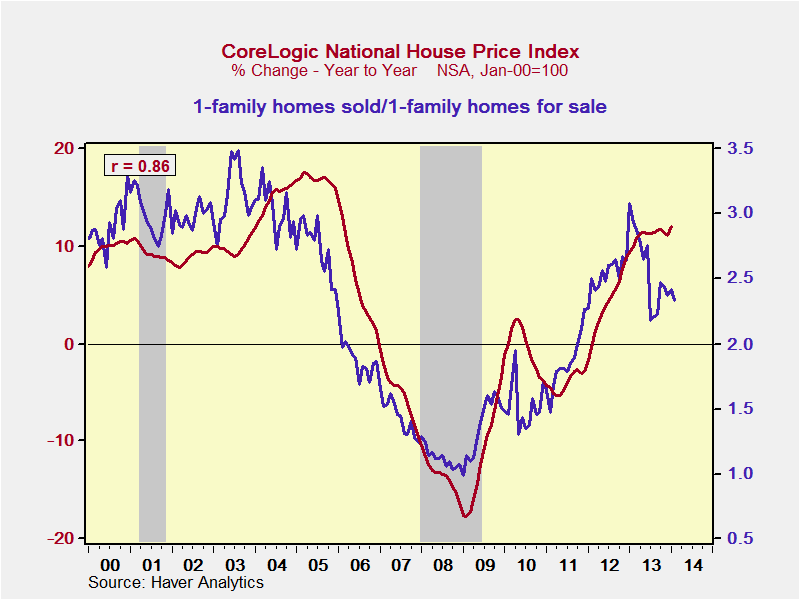

The change in the market weather hasn’t been nearly as quick, but it has been even more pronounced. Taking a look at the market over the past couple of months, it’s clear that the narrative has changed, which probably portends continued strong performance.