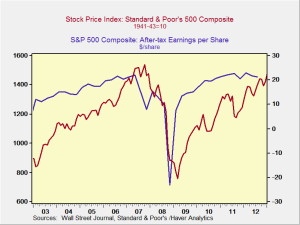

We’ve hit a record with the Dow and are getting very close with the S&P 500. Excitement is building, and the expectation is that stock prices will continue to rise. They may, for a while, based on the psychology alone, but as I discussed in the CFA Institute post last week, the financial fundamentals have to come into play at some point.

Ultimately, for a market rally to be sustainable, earnings per share—the metric that defines the financial benefit to shareholders—has to increase. The question now is whether the current rally is actually based on increases in earnings and, if so, whether that growth can continue.