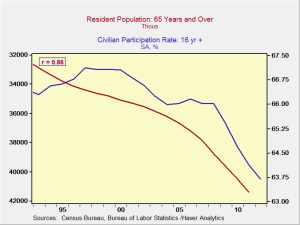

In yesterday’s post, I wrote that higher costs will result in lower growth. We also have other reasons to be concerned that future growth rates won’t match those of the past—with significant impacts on investing.

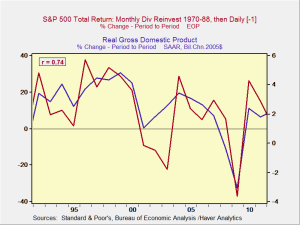

Here’s the short version: lower future economic growth is very likely to result in lower future stock returns. I’ll get into the details below, but one chart makes the case quite clearly.