Making New Year’s resolutions usually involves some level of reflection on how to be a better person and the possibilities ahead. You might write down your goals for the future, while also looking back on your accomplishments (and failures). In doing so, you may find growth where you didn’t expect it, even if it comes in the form of small wins toward your bigger goals.

Making New Year’s resolutions usually involves some level of reflection on how to be a better person and the possibilities ahead. You might write down your goals for the future, while also looking back on your accomplishments (and failures). In doing so, you may find growth where you didn’t expect it, even if it comes in the form of small wins toward your bigger goals.

Looking back at markets, 2023 was certainly a year that may not have seemed so great. With companies yet to report for the fourth quarter, earnings for the year are expected to be flat, which would be the worst year of earnings growth since the world was turned upside down in 2020. Before that, the last time we had flat earnings growth was in 2016. Of course, not every year is smooth sailing. Still, coming into 2023, many anticipated things would be much worse. Investors expected that inflation would remain high or that high interest rates would crush earnings. From that perspective, the economy was resilient, with inflation moving to a more benign place.

So, what are the expectations for the fourth quarter, and how will markets judge whether it was successful—or not?

Another Quarter of Low Expectations

With several big banks set to report tomorrow, the S&P 500 as a whole is expected to report earnings growth of 1.3 percent, with revenue growth of 3.1 percent. While every sector except energy beat earnings expectations in the third quarter, the real problem was that expectations were lowered for the future. When we started the Q3 earnings season, expectations were for growth of more than 8 percent in Q4. So, despite beating Q3 expectations, markets didn’t see much of a positive boost from earnings because future expectations had been lowered.

It wasn’t until later in the quarter, when inflation came in below expectations and the Fed started to indicate that rate hikes were over, did the market start taking off. With earnings expectations low for the fourth quarter, it may be another low bar for companies to beat. Investors will likely be looking for companies to provide good guidance for the year ahead to match expectations. Analysts expect earnings growth to be 12 percent in 2024 to go along with revenue growth of 5.5 percent, which could be difficult to live up to.

A Look Below the Surface

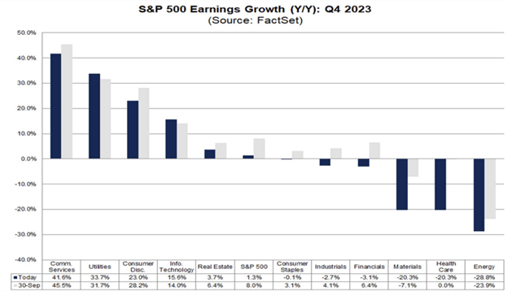

While earnings expectations for the market as a whole are low this quarter, there’s a wide range of expectations when looking at individual sectors. Only 5 of 11 sectors are expected to see earnings growth in the fourth quarter. Communication services, utilities, and consumer discretionary are all expected to see earnings growth of over 20 percent. On the other hand, materials, health care, and energy are all expected to see earnings declines of more than 20 percent. When earnings start to roll in, there can be some very different market reactions depending on which sector is reporting.

Note: FactSet consensus analyst forecasts as of January 5, 2024.

What’s Ahead for 2024

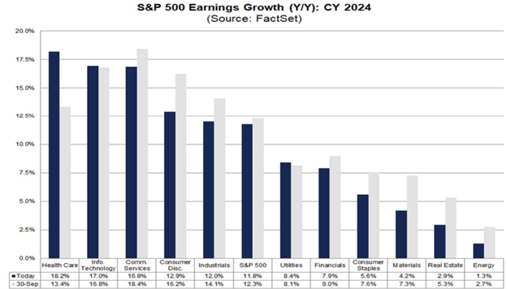

One thing that all sectors have in common is that analysts expect earnings growth in every sector for 2024. Materials and energy, which have low expectations for Q4, also have low expectations in 2024. Energy also happens to be the only sector with a valuation below its 25-year average, outside of the relatively newly created communication services sector. Tech and consumer discretionary, which are some of the fastest-growing sectors and could benefit from a soft landing in the economy with a strong labor market, have some of the highest expectations. These firms will need to show the strongest future guidance when they report, as they have valuations above 25x their forward-earnings projections.

Note: FactSet consensus analyst forecasts as of January 5, 2024.

The optimism in 2024 versus the pessimism with which we began 2023 has also led to higher valuations across the board, with the S&P 500 trading above 19x forward-earnings versus just below 17x at the start of 2023. This means that markets can still rise as companies report earnings growth, but it might be harder to be rewarded with multiple expansions for earnings beats like they were last year.

The Long View

Earnings season expectations may define how markets measure success in 2024, just as they did in 2023. As investors, it’s important we still look at the long-term picture. Even if earnings fail to meet high future expectations, continued earnings growth in the fourth quarter could continue to put stocks in a solid position for the future. And as we all look at our own resolutions, we shouldn’t discount the small wins, even if they don’t last the whole year.

Print

Print