Everyone has their Thanksgiving favorites, whether that’s the turkey, the mashed potatoes, the stuffing, or the gravy. For me, it’s the pie—blueberry with my mom’s homemade whipped cream.

Everyone has their Thanksgiving favorites, whether that’s the turkey, the mashed potatoes, the stuffing, or the gravy. For me, it’s the pie—blueberry with my mom’s homemade whipped cream.

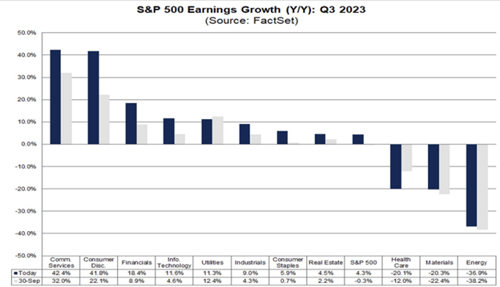

Before we dig into our Thanksgiving feasts, though, let’s take some time to digest the third-quarter earnings. After several quarters of declines, Q3 earnings beat expectations quite handily, given low expectations, and knocked us out of the earnings recession we’ve been in. Of course, like any good Thanksgiving meal, the resulting food coma could affect expectations for the quarter ahead. Let’s take a closer look.

The Main Course: What Drove Q3 Earnings

With 94 percent of the S&P reporting for the quarter, 82 percent of companies reported results above their earnings per share estimates. This would be the highest number of companies beating expectations since the third quarter of 2021 and 8 percent above the 10-year average. With 6 percent of companies yet to report, the expected earnings growth rate for the quarter of 4.3 percent is now well above the 0.3 percent decline expected going into earnings season (according to FactSet consensus analyst estimates as of November 17).

The biggest drivers of earnings for the quarter were the large gains in the communication services and consumer discretionary sectors, with financial services and tech sectors making strong side dishes. Going into the quarter, communication services and consumer discretionary were expected to be strong performers and still blew away expectations.

Note: Data as of November 17, 2023

Within communication services, the turnaround from T-Mobile helped see a jump of 320 percent within the wireless telecom services industry. But it was still one of the so-called Magnificent Seven (i.e., Apple, Microsoft, Amazon, Google, Nvidia, Tesla, and Meta) that provided the biggest boost to the sector: Meta saw an earnings beat of more than double expectations on better digital advertising revenue and lower expenses, accounting for one-third of the sector’s earnings growth.

For consumer discretionary, Amazon was the big winner, handily beating earnings estimates and accounting for more than 40 percent of the sector’s gains. On an industry level, it was hotels, restaurants, and leisure that saw huge gains, including those from several cruise lines that are seeing robust demand from consumers willing to spend on travel.

While tech and financials didn’t beat to the same degree as those sectors, they make up just over 40 percent of the S&P 500. Solid performance by these sectors helped move the S&P earnings further into positive territory.

Don’t Forget Your Vegetables: What Didn’t Taste So Great

On an absolute basis, the energy sector was the biggest detractor for earnings in the third quarter. This was primarily driven by falling commodity prices after we saw huge gains in oil and gas prices in 2022. Most of this was expected, however, and the jump in energy prices toward the end of the quarter helped the energy sector beat revenue and earnings expectations.

The hardest quarter relative to expectations came from health care. At the beginning of the quarter, health care was expected to have it tough, with a 12 percent decline in earnings. But a bad quarter from two Covid-19 vaccine heavyweights, Pfizer and Moderna, really hurt the earnings picture, sending health care down 20 percent. Without those two firms included, the performance of the health care sector would have been flat. Both took steep write-downs of their Covid-19 product inventories as demand has started to wane for vaccines and therapeutics.

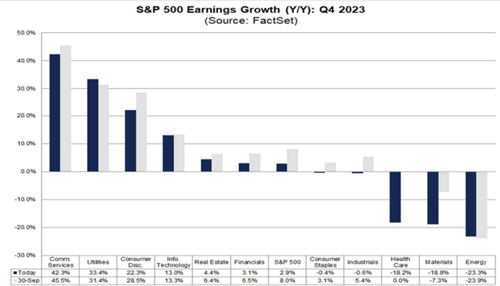

Hangover Ahead? Expectations for Q4

While the third quarter was good overall, the market response was at least somewhat muted until the inflation report sent the market and valuations higher due to many firms lowering their guidance for the fourth quarter, offsetting many of the earnings beats in the third quarter. While some of the declines came from sectors that performed well in the third quarter (e.g., consumer discretionary and communication services), health care saw a big write-down of expectations for the fourth quarter going from flat to –18.2 percent.

Note: Data as of November 17, 2023

While it may be easier to beat expectations for the fourth quarter with expectations down to 2.9 percent earnings growth, the market still has lofty expectations for the year ahead. The S&P 500 is expected to grow earnings by 11.6 percent in 2024. So, forward guidance and healthy profit margins, which continued to expand in the third quarter, will continue to remain important for supporting the 18.6x forward earnings multiple of the S&P 500.

Of course, this may be a case of the market’s eyes being too big for its stomach. But for now, I’m going to enjoy my pie. Happy Thanksgiving to all.

Print

Print